According to the St. Louis Federal Reserve, the commercial real estate (CRE) market was valued at $22.5 trillion in the fourth quarter of 2023, with a total CRE debt outstanding of $5.9 trillion. Banks hold 50% of the CRE debt, followed by government-sponsored enterprises (GSEs) at 17%. The CRE lending by U.S. banks has grown substantially over the past decade, with regional and community banks holding roughly two-thirds of all CRE loans. Bank executives are concerned about potential weaknesses and risks associated with banks’ large share of CRE debt. Net operating incomes for office assets are particularly worrisome.

Source: St. Louis Federal Reserve (June 2024)

“Challenges in the commercial real estate market remain a potential headwind for the U.S. economy in 2024 as a weakening in CRE fundamentals, especially in the office sector, suggests lower valuations and potential losses. Banks are preparing for such losses by increasing their allowances for loan losses on CRE portfolios, as noted by the April 2024 Financial Stability Report. In addition, stronger capital positions by U.S. banks provide added cushion against such stress.3 Nevertheless, stress in the commercial real estate market is likely to remain a key risk factor to watch in the near term as loans mature, building appraisals and sales resume, and price discovery occurs, which will determine the extent of losses for the market.”

The Real Deal reports on commercial real estate, highlighting that bank exposure to commercial real estate, particularly through real estate investment trusts (REITs), is greater than previously realized. A recent study led by economists found that big banks’ exposure to commercial real estate lending increases by 40% when indirect REIT lending is considered. This type of exposure is not receiving as much scrutiny as loans on bank balance sheets, potentially posing a risk.

According to Heather Gillers of the Wall Street Journal (subscription required), government pension plans face repercussions from the commercial real estate downturn. For instance, Canada’s national pension plan is selling off stakes in Manhattan and San Francisco office towers at a $225 million loss. California’s government worker pension fund has also sold off a property in Sacramento after trying to develop it for nearly twenty years. Consultants have cautioned California’s teacher pension plan about ongoing negative effects on returns from office holdings following a 9% real estate loss in 2023.

Samantha Barnes of International Banker picks up on this story, reporting that the global commercial real estate sector, particularly in the U.S., faces significant pressure due to elevated interest rates. With a large volume of property debt set to mature in the next three years, there are concerns that the US banking sector could be at risk of another major crisis if commercial real estate loan default rates rise. This is worrisome as commercial real estate loans represent a substantial share of the total banking system’s assets. The current struggle for borrowers to repay loans issued at low interest rates in the past is placing immense strain on lenders.

Home sale data

Hannah Jones of Realtor.com reports on pending home sales, which declined 7.7% in April to a 4-year low. As sales shrunk, resale supply hitting the market increased over 30% in April, keeping prices steady as more inventory hit the market.

Source: Realtor.com (June 2024)

“Pending home sales, or contract signings, measure the first formal step in the home sale transaction—the point when a buyer and seller have agreed on the price and terms. Pending home sales tend to lead existing-home sales by roughly one to two months and are a good indicator of market conditions…Buyers holding off for lower rates might step into the market this summer, eager to take advantage of any improvements in affordability, as well as ample for-sale inventory in many markets. However, for some would-be buyers, purchasing a home remains unattainable, and renting is a more attractive option, especially as rents continue to ease.”

The National Association of Realtors (NAR) comments on the above data, highlighting that “all four regions showed declines from a year ago. The Midwest region had the biggest decrease of 8.7%, followed by the South with a decline of 8.2%. The West fell 7.3%, followed by the Northeast with a reduction in sales of 3.1%. From last month, all four regions showed declines in contract signings. The Midwest had the biggest dip of 9.5%, followed by the West with a decrease of 8.5%. The South fell 7.6%, and the Northeast had a drop in contracts of 3.5%.”

Amidst higher resale supply, Dana Anderson of Redfin reports that 6.4% of sellers reduced their sales price in April, with the median asking price dropping to $416,623. This was the first decline in six months. In addition, the age of inventory is increasing, indicating that homes are staying on the market longer. These trends suggest that home sale-price growth may soften in the upcoming months due to high mortgage rates deterring potential buyers. Despite this, the median home sale price is still up 4.3% year over year, reaching a new record high.

Source: Redfin (June 2024)

Orphe Divounguy of Zillow comments on the above pending home sale data, noting that “Because sellers are returning to the housing market, the gap between supply and demand is closing and for-sale inventory is rising again. Unsold inventory sits at just 3.5-month supply compared to 3.0 months in April 2023. Although higher inventory points to the potential for more price cuts and easing price growth, well-marketed and competitively priced listings are selling fast and prices are still rising. According to Zillow data, homes that sold did so in just 13 days – faster than the pre-pandemic norm of 21 days.”

Renters

New rent data from Zumper shows that both one and two-bedroom rents increased by 1.2% in May, with median prices reaching $1,504 and $1,865, respectively. This is the first time in 20 months that we’ve seen monthly growth rates of over 1%. The increase in our national rent index, combined with ongoing inflation, suggests that there will be more pressure on the Consumer Price Index (CPI) shortly, and rate cuts may be further delayed.

Source: Zumper (June 2024)

Zumper reports that Syracuse, NY, and Columbus, OH, had the largest annual rent price growth rates. Syracuse saw rent increase by 28.6%, and Columbus’s rent climbed by 22.5%.

The June 2024 Apartment List National Rent Report shows a similar trend, with rent prices increasing for the fourth consecutive month. Overall rental growth throughout 2024 has been modest, indicating continued sluggishness in the market. The national median rent increased by 0.5% in May, reaching $1,404, but the growth rate slowed slightly this month. Typically, rent growth accelerates during the busy moving season at this time of year, so the sluggish growth this month suggests the market is heading for another slow summer.

Source: Apartment List (June 2024)

“Since the second half of 2022, seasonal declines have been steeper than usual and seasonal increases have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.8 percent and has now been in negative territory since last summer. But despite this cooldown, the national median rent is still more than $200 per month higher than it was just a few years ago.”

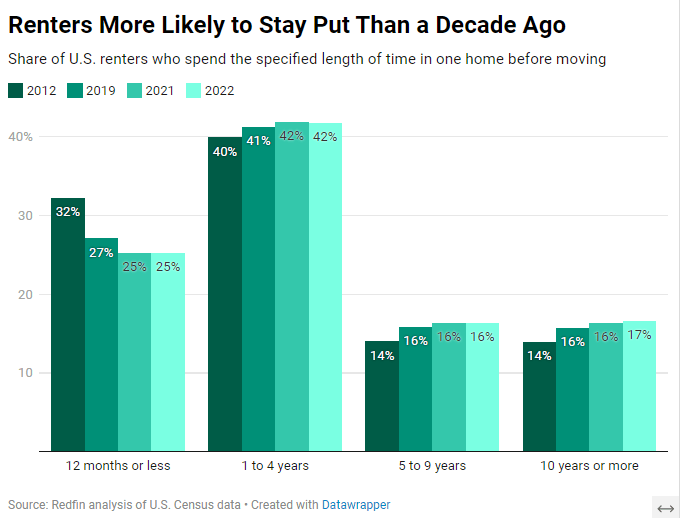

Dana Anderson of Redfin reported on rent prices, highlighting that 16.6% renters stayed in their unit for 10+ years as of 2022, up from 13.9% in 2012. This is primarily because high housing costs have made homeownership unattainable for many. Additionally, the increasing prevalence of remote work has also contributed to more people opting for the renting lifestyle due to its flexibility and convenience. While most U.S. renters still move within five years, they are now more inclined to stay in one place for a longer period compared to a decade ago.

Source: Redfin (June 2024)

Redfin Senior Economist Sheharyar Bokhari comments on this new reality: “The uptick in tenure is beneficial for renters and their landlords…While the fact that people are staying longer in their rentals may mean they can’t afford to buy a home in today’s market, staying put also means they’re saving some money that could eventually go toward a down payment if they do have a goal of homeownership. Staying in the same home means they’re likely to face smaller rent increases, and they’re saving money on moving costs and application fees. Landlords typically prefer long-term tenants because they don’t have to spend money on cleaning and marketing vacant units.”