Keeping a shoebox full of receipts is no longer necessary or practical for busy rental property owners who want to run an effective business.

There are now quite a few rental property accounting software platforms available to help landlords automate and manage nearly every financial aspect of their business. These solutions sometimes include robust mobile apps and are great at helping you track rental property expenses, income, deductions, and other key real estate investing metrics.

Here’s a detailed overview of the best accounting software solutions for landlords. We’ll help you find the one that suits your particular needs, budget, and investing experience.

What to look for in a good rental property accounting tool

You should look for more than a simple accounting tool. Instead, you want a comprehensive, intuitive, and powerful software platform that’s purpose-built for the unique challenges and opportunities that come with managing rental properties.

Here are some key features we recommend you look for in a software platform:

- User-friendly interface: You want software that’s easy to navigate, especially if you’re not overly tech-savvy. An intuitive design makes managing your properties and finances straightforward.

- Extensive financial tracking: The platform should provide a relatively complete picture of your financial situation, including income, expenses, net cash flow, and valuations. Look for software that automatically categorizes transactions for easy analysis and reporting.

- Real-time reports: Access to real-time performance metrics like net operating income, appreciation, and cap rates can help you make more informed decisions about your properties.

- Automated rent collection: This feature streamlines the rent collection process. It sends rent reminders, alerts, and payment updates while reducing the need for additional third-party apps like PayPal, Venmo, or Zelle.

- Tenant screening services: This tool helps you mitigate potential financial losses by selecting responsible tenants with verified income sources, no evictions, and a solid track record.

- Integration capabilities: Your chosen software should integrate seamlessly with other platforms you use, such as property management portals or bank accounts. This way, all your information is in one place.

- Secure data storage: Your financial data should be safely stored and encrypted to help prevent unauthorized access.

- Scalability: Whether you have a single rental unit or a larger portfolio across multiple locations, choose a service that will scale according to your needs and future plans.

The top rental property accounting platform for landlords

Most of these top software picks have the essential features outlined above but differ in pricing. The one you choose depends on your needs as a landlord and the size and type of assets in your portfolio.

We’ll start with our own service used by over 250,000 landlords – Stessa.

1. Stessa

Stessa is a platform designed specifically for owners of residential rental properties.

Whether you’re a new investor with one rental unit or a seasoned professional managing a multi-family portfolio, Stessa offers an array of tools to streamline your operations and maximize your investment returns.

Stessa’s intuitive interface and robust features take the guesswork out of asset and property management, letting you focus on growing your rental business. Its unique positioning as “asset management” software sets it apart from traditional property management platforms.

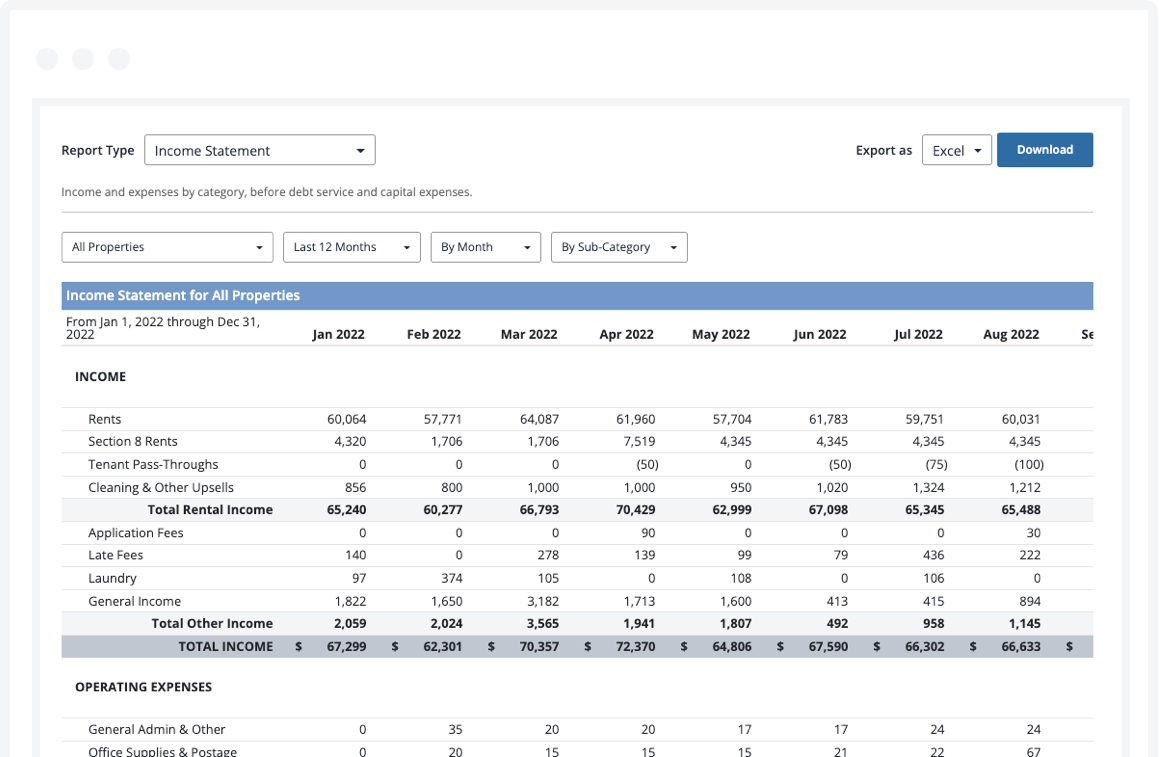

Built to help investors optimize portfolio performance across a number of key metrics, Stessa provides real-time visibility into critical financial and operational data, automates income and expense tracking, and even offers automated rent collection services.

Security is also a top priority for Stessa, with multi-layer encryption that helps protect sensitive information at rest and in transit.

Key features

Some other key features of Stessa include:

- Automated accounting tools: Replace cumbersome spreadsheets and easily track income and expenses. Stessa automates the process of categorizing transactions, reducing time spent on manual data entry.

- Manual expense tracking: Enjoy precise recordkeeping of all property-related expenses, from maintenance costs to insurance fees, for a comprehensive view of property expenditures.

- One-click smart receipt scanning: Quickly and accurately add expense receipts to your transactions ledger via mobile scans and email forwarding, thereby reducing the risk of losing or misplacing vital receipts.

- Mileage tracking: Track all travel related to your property management efforts for accurate expense reporting. This feature is particularly beneficial for tax purposes, as you can sometimes deduct these costs from taxable income.

- Automated bank feeds: Connect unlimited bank accounts for real-time income and expense tracking so you can manage your cash flow effectively and stay on top of your financial situation.

- Centralized dashboard with key metrics and complete chart history: Access a clear real-time overview of your property performance. The dashboard displays critical metrics and historical data in an intuitive, easy-to-understand format.

- Rental applications: Manage tenant applications efficiently and effectively by streamlining the process of publishing vacancies, and collecting and reviewing applications.

- Tenant screening: Use a proprietary approach with RentPrep for comprehensive tenant checks, including a full credit report, background check, and more. For additional screening, landlords can add income verification or judgment and liens, further increasing the odds of selecting reliable tenants.

- Online rent collection: Automate your rent collection process, including payment reminders and late fees, reducing the likelihood of missed or late payments.

- Landlord banking: Open FDIC-insured bank accounts and enjoy a more efficient way to manage your property-related finances. You can also earn more than 10x the national average interest rate on every dollar of deposits.*

- Mobile app (iOS and Android): Utilize Stessa’s mobile app to help you manage your properties on the go. You can categorize transactions, check key metrics, scan receipts, and view your portfolio from almost anywhere, anytime.

- eSigning: Simplify lease signing and other document execution with integrated eSignature capabilities from DocuSign. This feature makes it easier for landlords and tenants to sign important documents, reducing the need for in-person meetings.

- Tax center: Tax time is a cinch thanks to the Stessa Tax Package feature. It helps aggregate your transactions and sends you personalized tax reports via email with digital copies of all of your receipts packaged into a single ZIP file.

Pricing

Stessa has a robust free option called Essentials, in addition to multiple paid plans for investors who want to take advantage of more advanced features:

Essentials Manage Pro

PRICING

Free $15/month

($12/mo when paid annually)$35/month

($28/mo when paid annually)

ASSET MANAGEMENT

Track properties Unlimited Unlimited Unlimited

Dashboards Key metrics only Key metrics only Full chart history

Property manager connections Unlimited Unlimited Unlimited

Document & receipt storage Unlimited Unlimited Unlimited

Organize & manage portfolios 1 1 Unlimited

Shared account access Yes Yes Advanced ownership metrics

BOOKKEEPING/ACCOUNTING

Advanced transaction tracking No No Yes

Smart receipt scanning 5/month 5/month Unlimited

Manual expense tracking Yes Yes Yes

Automated bank feeds Unlimited Unlimited Unlimited

Budgeting & pro-forma analysis No No Yes

Project expense tracking No No

Yes

REPORTING & TAXES

Reporting level Basic Basic

Advanced

Full data export Yes Yes Yes

Accountant tax package Basic Plus Schedule E Plus CapEx

BANKING

High yield Cash Management 2.31% APY* 2.31% APY* 3.98% APY*

FDIC insured up to $2.5M/entity Yes Yes Yes

No minimum balance Yes Yes Yes

1.1% cash back on purchases Yes Yes Yes

ONLINE RENT COLLECTION

Accelerated rent payments No Yes Yes

Automated reminders and late fees Yes Yes Yes

Tenant autopay Yes Yes Yes

Tenant ledger and rent roll Yes Yes Yes

Tenant ACH fee waived No No Yes

LEASING

Vacancy advertising Yes Yes Yes

Syndication to Zillow Yes Yes Yes

Tenant applications & screening Yes Yes Yes

Lease template No Yes Yes

DOCUMENT MANAGEMENT

eSign leases, contracts, etc. No 1/month 7/month

60+ Forms and templates No Yes Yes

CUSTOMER SUPPORT

Basic support Yes Yes Yes

Priority chat support No Yes Yes

Live phone support No No Yes

Get Started Get Started Get Started

You can always start with the Essentials plan and upgrade to a paid plan as your portfolio expands and your needs evolve.

2. QuickBooks

QuickBooks(R) is a well-known accounting software service that businesses use across various industries, including real estate. It handles general business accounting needs, from invoicing and expense tracking to tax preparation and financial reporting. Quickbooks is incredibly flexible and powerful, which can sometimes make things more complicated than they need to be, especially when it comes to rental property finances.

QuickBooks isn’t designed solely for rental property management, which may result in a steeper learning curve for landlords looking to manage their portfolios online. Also, while the software offers an extensive suite of specific tools and features, its broad focus means it may have features that aren’t as relevant for landlords and may lack some functionality that landlords need.

Key features

- Expense tracking: Categorize and track expenses, making it easier to monitor costs and prepare for tax season.

- Invoicing: Create and send invoices through QuickBooks, allowing for streamlined payment collection.

- Financial reporting: Generate several types of financial reports to get an overview of your business health.

- Tax preparation tools: Organize income and expenses in a tax-friendly way, simplifying the tax filing process.

- Integration capabilities: QuickBooks connects with many platforms, though its compatibility with specific property management tools may vary.

Pricing

QuickBooks has several pricing tiers, each with a different set of features. All plans come with a 30-day free trial and 50% off for the first 3 months:

- Simple Start: At $35/month, this plan has basic features like income and expense tracking, invoicing, and basic reporting.

- Essentials: Priced at $65/month, this tier includes bill management and time tracking.

- Plus: At $99/month, you get additional features like project and inventory tracking.

- Advanced: For $235/month, this plan offers more advanced reporting and automation capabilities.

Who is QuickBooks ideal for?

- Landlords or property managers handling a small to midsize portfolio

Does QuickBooks have a mobile app?

- Yes

3. AppFolio

AppFolio is property management software that caters primarily to professional property managers with residential, commercial, and student housing properties.

While it has a range of tools, including online rent payment, vacancy posting, and maintenance requests, AppFolio may end up being a lot more muscle than the typical rental property owner needs. As a result, it may not be economical for independent landlords who self-manage their properties.

Key features

- Online rent payment: Conveniently collect rent online.

- Maintenance management: Coordinate and track maintenance work orders.

- Vacancy posting: Share your vacancies on popular housing search websites from the platform.

- Tenant screening: Screen prospective renters using background checks and credit reports.

- Tenant communication tools: Renters and owners can communicate directly through the platform.

Pricing

AppFolio tailors its pricing structure to the size of your portfolio. They offer three main residential plans: Core, Plus, and Max. AppFolio no longer puts pricing directly and their site, so you’ll need to contact them for a quote.

Who is AppFolio ideal for?

- Professional property managers with midsize to large portfolios of rental properties

Does AppFolio have a mobile app?

- Yes

4. Buildium

Buildium(R) is a property management solution for professional property managers overseeing multiple properties. Its features help with tenant screening, rent collection, accounting, and more.

However, the software’s focus on professional property management may make it more complex than necessary for individual landlords and real estate investors self-managing their properties.

Key features

- Rent collection: Automate rent collection and streamline payments.

- Tenant screening: Perform background checks and credit reports for potential tenants.

- Financial management: Track income and expenses, manage bills and vendors, and generate financial reports.

- Lease and document management: Store all lease agreements in one place and track lease terms.

- Maintenance request tracking: Manage and track maintenance requests from tenants.

Pricing

Buildium has tiered pricing based on the number of units managed. Each package comes with a 14-day free trial:

- Essential: This plan includes basic property management features and starts at $58/month.

- Growth: Starting at $183/month, this plan has more advanced features like unlimited eSignatures on leases, addendums, and data exporting.

- Premium: Starting at $375/month, this plan adds premium capabilities like priority phone support and a dedicated customer success manager.

Who is Buildium ideal for?

- Serves landlords and property managers across diverse properties, from single-family to commercial, scaling up to over 15,000 units

Does Buildium have a mobile app?

- Yes

5. Landlord Studio

Landlord Studio is property management software that helps landlords and property managers track their rentals’ regular income and expenses.

Landlord Studio’s capabilities are more focused on day-to-day bookkeeping. While its basic features can be beneficial, it may be of less value to landlords or investors who want broader asset management and portfolio optimization.

Key features

- Rent collection: Simplify the payment process with online rent payments.

- Expense tracking: Categorize and track property-related expenses.

- Tenant screening: Use tools to screen potential tenants with credit checks and background reports.

- Property accounting: Basic accounting features to manage income and expenses for individual properties.

- Reporting: Generate basic financial reports for individual properties.

Pricing

Landlord Studio offers two pricing plans catered to different needs:

- Go: This free plan lets you manage up to 3 units. It includes basic features such as rent collection, manual income and expense tracking, and creating financial reports.

- Pro: Pricing begins at $15/month for 3 units ($1.20 for each additional unit), with a discount for annual billing. There is no unit limit, and the plan includes advanced features such as automated bank feeds and Xero integration.

- Pro Plus: Pricing begins at $35/month for 3 units ($1.20 for each additional unit), and includes additional features like additional users, a dedicated account manager, unlimited document storage, and additional accounting limits.

Who is Landlord Studio ideal for?

- DIY landlords and small to mid-sized property managers looking for a cloud-based, mobile-first tool

Does Landlord Studio have a mobile app?

- Yes

6. Xero

Xero is cloud-based accounting software for small to medium-sized businesses across numerous industries. It has robust accounting features such as invoicing, bank reconciliation, and financial reporting.

However, Xero doesn’t have purpose-built property management or real estate investment features. Landlords might pay for several functions they don’t need and miss out on more specific features that a specialized platform like Stessa provides.

Key features

- Invoicing: Create and send custom invoices directly from the platform.

- Bank reconciliation: Automatically import and categorize bank transactions.

- Financial reporting: Generate income statements, balance sheets, and other financial reports.

- Multi-currency: Certain plans allow users to handle multiple currencies with exchange rates updated hourly.

Pricing

Xero has 3 pricing plans with a 30-day free trial and a discount for the first 6 months, depending on the plan selected:

- Early: Regularly priced at $20/month, this entry-level plan allows you to send 20 invoices and quotes, enter 5 bills, and reconcile bank transactions.

- Growing: Regularly priced at $47/month, you get unlimited invoices, quotes, bills, and bank transactions.

- Established: Regularly priced at $80/month, this top-tier plan has additional features like multi-currency, expense claims, and project tracking.

Who is Xero ideal for?

- Small businesses looking for an online accounting software solution

Does Xero have a mobile app?

- Yes

7. Hemlane

Designed as a comprehensive solution for property management, Hemlane is for landlords, property managers, and real estate investors. It offers a variety of tools for tasks like rent collection, maintenance coordination, advertising, and tenant screening.

However, Hemlane’s services may be more aligned with hands-on property management rather than optimizing investment performance.

Key features

- Rent collection: Automate rent collection and track payments.

- Maintenance coordination: Manage and coordinate repair requests.

- Tenant screening: Screen tenants using credit checks and background reports.

- Lease management: Track lease terms and store agreements digitally.

- Financial tracking: Utilize basic income and expense tracking functions.

Pricing

Hemlane’s paid plans start with a $36.50 monthly platform fee, added to the per-unit cost. There is a 14-day free trial for each package, and annual billing gives you a discount on per-unit cost and the monthly platform fee:

- Free: The free plan gives you advertising to 4 listing sites, tenant screening, and accounting.

- Basic: Priced at $2.50/unit/month, totaling $36.50 for one unit with the base fee. It includes marketing syndication plus lease management and rent collection.

- Essential: This plan costs $24/unit/month, which adds up to $58 for one unit with the base fee. Additional features include state-specific leases and repair coordination through a dedicated coordinator.

- Complete: The most comprehensive package, priced at $80/unit/month, is $114, including the base fee for one unit. This plan has all the Basic and Essential features plus extras, such as full repair coordination and access to a network of service pros.

Who is Hemlane ideal for?

- Less price-sensitive landlords with less than 100 units seeking an all-in-one property management solution

Does Hemlane have a mobile app?

- No

8. Avail

Avail is another online tool serving landlords and property managers. It has a range of features designed to streamline property management tasks.

While useful for landlords looking for basic tenant management tools, Avail may not be a perfect match for those seeking a detailed overview of their investment performance and insights that help guide key investment decisions.

Key features

- Rent collection: Set up automatic payments with online rent collection.

- Lease agreement: Create and sign digital lease agreements.

- Maintenance tracking: Tenants can use the platform’s portal for submitting maintenance work orders.

- Listing syndication: Post your rental listings to popular websites.

Pricing

Avail operates on a tiered pricing structure:

- Unlimited (free): Avail’s free plan offers basic features for an unlimited number of units.

- Unlimited Plus: This plan costs $9/unit/month and includes premium features like FastPay rent collection, customizable applications and leases, and the ability to create property websites.

Who is Avail ideal for?

- Landlords who want to manage rental listings, screen tenants, and handle rent payments online without a property manager

Does Avail have a mobile app?

- No

9. REI Hub

REI Hub offers a comprehensive, property-focused accounting framework, offering features such as automatic transaction importing, time-saving templates, and rule-based transaction matching.

Users can track income, expenses, and tax obligations efficiently. Investor-focused features include editable charts of accounts, fixed asset schedules, and built-in Schedule E reports.

However, landlords who require comprehensive tenant management features beyond accounting capabilities may find REI Hub lacking compared to more all-in-one property management solutions.

Key features

- Automatic transaction importing: Simplify your bookkeeping by electronically linking to your bank for easily importing transactions.

- Property-based accounting framework: Detailed, per-property financial tracking and reporting optimize property management.

- Editable chart of accounts tailored for investors: The customizable accounting is pre-configured for real estate investment needs.

- Built-in Schedule E reports and fixed asset schedules: Streamline tax preparation with the simple generation of essential tax documents, asset tracking, and depreciation.

Pricing

REI Hub offers 4 pricing plans based on the number of units under management. All plans come with the same suite of features and include a 14-day free trial:

- Essentials: $15/month for up to 3 units

- Growth: $25/month with 10 units included

- Investor: $45/month for 20 units

- Professional: $80/month with an unlimited number of units

Who is REI Hub ideal for?

- Landlords, real estate investors, and their financial advisors who seek a property-focused accounting system

Does REI Hub have a mobile app?

- Yes

10. Rentec Direct

Rentec Direct is a cloud-based property management software designed for DIY landlords managing a few units to professional property managers overseeing extensive portfolios.

In addition to features such as publishing vacancies online, tenant screening, and financial reporting, landlords can pay for 3rd-party services like Payscore, Dropbox Sign, and zInspector, allowing users to incorporate additional tools and applications.

One drawback of Rentec Direct is the pricing structure starts at $50/month per unit. This fee can be relatively high for landlords managing only a small number of properties, potentially making it less cost-effective for smaller portfolios.

Key features

- Accounting: Access a comprehensive software suite for property and tenant accounting, including full general ledger accounting and tracking and management of individual properties and portfolios.

- Operations: Simplify day-to-day tasks with features like a tenant portal, professional website creation, and online tenant payments.

- Leasing and management: Facilitate the entire leasing process, from tenant screening to lease signing.

- Vacancy syndication: Automatically publish vacant properties across leading rental listing sites like Apartments.com and Realtor.com to maximize exposure and fill vacancies faster.

Pricing

The company offers 2 pricing plans. Rentec Pro is for landlords and investors, while Rentec PM is for property managers. Both plans come with a two-week free trial and a discount for annual billing:

- Rentec Pro: This plan starts at $50/month for up to 25 units and includes complete accounting and reporting as well as free online rent payments.

- Rentec PM: This plan starts at $50/month for up to 20 units, with everything included in Rentec Pro plus property management features like marketing and maintenance management, paying owners via ACH, and trust account management and reporting.

Who is Rentec Direct ideal for?

- Designed for residential and commercial landlords and property managers with 1–5,000 units

Does Rentec Direct have a mobile app?

- Yes

11. SimplifyEm

SimplifyEm offers a suite of tools that include online leasing, rent collection, lease management, resident portals, and financial reporting. The platform is engineered to support various property types including residential homes, multi-family rentals, commercial properties, and community associations.

However, contrary to the name of the software, some landlords may view the pricing structure of SimplifyEm as complicated, with 8 different pricing plans and additional fees for tasks such as advertising vacancies or online payments.

Key features

- Full income and expenses tracking: Enable detailed financial management for your properties.

- Generate detailed reports: Gain insights into cash flows and other financial metrics.

- Manage tenant and lease information: Centralize tenant data and lease details in one accessible location.

- Manage vendors and year-end taxes: Facilitate interactions with service providers and simplify tax preparation.

- Unlimited document storage: Store property-related documents securely online.

Pricing

SimplifyEm has 8 different pricing plans with various features based on the number of units. The company provides a free 15-day trial for all plans:

- P10: $40/month for up to 10 units

- P20: $50/month for up to 20 units

- P30: $60/month for up to 30 units

- P50: $75/month for up to 50 units

- P75: $95/month for up to 75 units

- P100: $115/month for up to 100 units

- P100+: $10 extra/month for every 10 additional units

- P2000: $2,015/month for up to 2,000 units

Users on the P10, P20, and P30 pricing plans can purchase additional features, such as bank account management, tenant and owner portals, late fee automation, and exporting to QuickBooks and Excel for an extra $10/month.

There may also be additional fees for tasks, such as advertising vacancies, rental applications and lease forms, and online payments, which depend on the pricing plan you select.

Who is SimplifyEM ideal for?

- Designed for property managers, landlords, and investors with small to mid-sized portfolios

Does SimplifyEm have a mobile app?

- Yes (for tenants)

Join over 250K+ landlords using Stessa

There are many options in this sea of accounting software solutions.

However, Stessa’s unique features and user-friendly design, tailored to individual landlords and real estate investors regardless of portfolio size, help it stand out from the rest.

From automatic income and expense tracking to comprehensive performance metrics, Stessa works to give you the necessary tools to manage your properties efficiently. Plus, its state-of-the-art security measures help ensure your data is protected, offering you peace of mind.

Try the free Essentials plan today, and experience how Stessa can help you run your rental property like the successful business you deserve to own.

*Stessa is not a bank. Stessa is a financial technology company.Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.