Having the right tools at your disposal can make a world of difference in property management. If you’re a landlord seeking strategies for streamlining your operations and maximizing profitability, you’ve probably come across two respected software solutions: Stessa and TurboTenant.

These popular platforms have been making waves in the industry, each promising to revolutionize how you manage your residential rental properties. So, how do you decide which one is right for you?

This article presents a comprehensive comparison of Stessa versus TurboTenant. We break down their features, pricing, and overall offerings. We also explore what sets them apart and, more importantly, how they can serve your unique needs as a landlord.

Instead of weighing which platform is better, the key is to find the best fit for your property management needs. Let’s start by taking a look at this overview, which summarizes the key features and pros and cons of both platforms:

|

Stessa |

TurboTenant |

|

| Key features |

|

|

| Pricing |

|

|

| Unique advantages |

|

|

| Limitations | Not a complete property management solution (no capability for handling maintenance requests, tenant communications, or lease agreements) |

|

| Final takeaway | Greater focus on helping real estate investors track financial transactions and optimize property investments | Greater focus on basic property management tasks, including a tenant communication portal |

What to know about Stessa and TurboTenant

Stessa is robust property management software designed to simplify the financial side of rental property ownership.

Offering a service rooted in automation, Stessa blends leasing, accounting, reporting, and banking into one platform. That makes it an ideal choice for landlords seeking to prioritize the financial elements of their operations.

TurboTenant aims to position itself as a one-stop shop for landlords wanting to streamline all day-to-day aspects of managing their rental properties. It offers an array of features, including property listings, online leases, and a tenant portal for maintenance requests.

Stessa overview

Stessa, a subsidiary of Roofstock, was created by and for residential rental property owners to meet their unique needs.

With features like revenue and expense tracking, data reporting dashboards, and tax-ready reports based on Schedule E, Stessa helps you efficiently manage your rental property investments. The platform integrates with your financial accounts and some property management portals, freeing you from the burden of physical paperwork.

To ensure you stay connected to your portfolio virtually anywhere, Stessa also offers mobile applications for iOS and Android devices. An automated receipt scanning function is especially beneficial during tax season, further simplifying property management tasks.

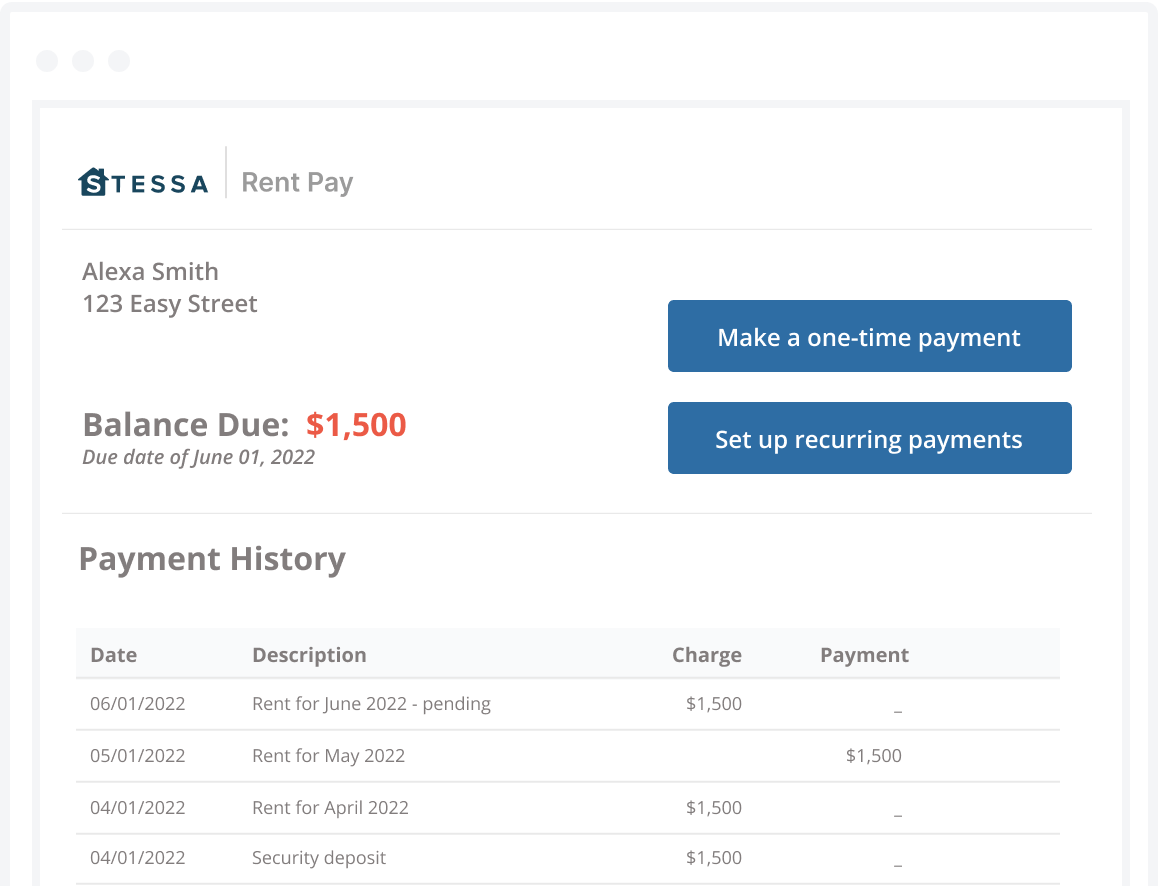

Stessa also offers tenant applications and screening, eSigning (available with the premium Pro plan), rent collection, high-APY landlord banking services, and document storage.

These extra features make Stessa more than just an accounting software platform. They transform it into a comprehensive property management solution that caters to the specific demands of residential property owners.

Pricing structure

Stessa’s tiered pricing structure suits a variety of requirements and budgets:

| Essentials | Manage | Pro |

|

|---|---|---|---|

| PRICING | |||

| Free | $15/month ($12/mo when paid annually) | $35/month ($28/mo when paid annually) |

|

| ASSET MANAGEMENT | |||

| Track properties | Unlimited | Unlimited | Unlimited |

| Dashboards | Key metrics only | Key metrics only | Full chart history |

| Property manager connections | Unlimited | Unlimited | Unlimited |

| Document & receipt storage | Unlimited | Unlimited | Unlimited |

| Organize & manage portfolios | 1 | 1 | Unlimited |

| Shared account access | Yes | Yes | Advanced ownership metrics |

| BOOKKEEPING/ACCOUNTING | |||

| Advanced transaction tracking | No | No | Yes |

| Smart receipt scanning | 5/month | 5/month | Unlimited |

| Manual expense tracking | Yes | Yes | Yes |

| Automated bank feeds | Unlimited | Unlimited | Unlimited |

| Budgeting & pro-forma analysis | No | No | Yes |

| Project expense tracking | No | No | Yes |

| REPORTING & TAXES | |||

| Reporting level | Basic | Basic | Advanced |

| Full data export | Yes | Yes | Yes |

| Accountant tax package | Basic | Plus Schedule E | Plus CapEx |

| BANKING | |||

| High yield Cash Management | 2.31% APY* | 2.31% APY* | 3.98% APY* |

| FDIC insured up to $2.5M/entity | Yes | Yes | Yes |

| No minimum balance | Yes | Yes | Yes |

| 1.1% cash back on purchases | Yes | Yes | Yes |

| ONLINE RENT COLLECTION | |||

| Accelerated rent payments | No | Yes | Yes |

| Automated reminders and late fees | Yes | Yes | Yes |

| Tenant autopay | Yes | Yes | Yes |

| Tenant ledger and rent roll | Yes | Yes | Yes |

| Tenant ACH fee waived | No | No | Yes |

| LEASING | |||

| Vacancy advertising | Yes | Yes | Yes |

| Syndication to Zillow | Yes | Yes | Yes |

| Tenant applications & screening | Yes | Yes | Yes |

| Lease template | No | Yes | Yes |

| DOCUMENT MANAGEMENT | |||

| eSign leases, contracts, etc. | No | 1/month | 7/month |

| 60+ Forms and templates | No | Yes | Yes |

| CUSTOMER SUPPORT | |||

| Basic support | Yes | Yes | Yes |

| Priority chat support | No | Yes | Yes |

| Live phone support | No | No | Yes |

| Get Started | Get Started | Get Started |

You can always start with the Essentials plan and upgrade to a paid plan as your portfolio expands and your needs evolve.

Features summary

- Automated income and expense tracking: Automatically sort and classify transactions from linked bank, lender, credit card, and property management accounts, all without any additional fees or required add-ons.

- Financial reporting: Generate income statements, net cash flow summaries, and balance sheets (available with the paid Pro plan), among other reports.

- Landlord banking: Open an FDIC-insured high-yield bank account* for each property and seamlessly integrate them with Stessa’s financial tracking features.

- Vacancy marketing: Publish a vacancy for rent and syndicate it out across a variety of websites for maximum exposure to high quality tenants.

- Rental applications and tenant screening: Use Stessa’s tenant screening services and free rental applications to find and select qualified tenants.

- Legal forms and templates: 60+ legal docs and eSigning via DocuSign

- Free rent collection: Collect rent through ACH payments, a free service for property owners and tenants.

- Real-time performance metrics: Get round-the-clock insights into the performance of your property portfolio.

- Property management integration: Link your property management portal to import transactions and get a detailed portfolio overview.

- Unlimited properties: Add an unlimited number of properties to your Stessa account.

- Collaborative access: Invite other investors, CPAs, spouses, and others to share your Stessa account. Manage their access levels to view and/or edit the account.

- Data security: Stessa employs industry-standard encryption and multi-factor authentication to help keep your data safe and secure.

- Tax resources: Access a suite of tax resources and educational materials created in partnership with The Real Estate CPA.

Pros

Stessa is packed with features, providing an effective and wide-ranging solution for residential real estate investors. Plus, it offers an in-depth view of your entire holdings, organized by portfolio. This is a key differentiator that many other competing platforms struggle to deliver as effectively.

With its real-time performance metrics and automated tracking of income and expenses, Stessa takes care of the busywork and delivers key insights about your portfolio. This high level of clarity is essential for making decisions and strategically planning future investments.

The platform’s ability to directly connect with your property management portal and financial accounts saves you considerable time and effort from manual data entry. The unlimited properties feature is especially advantageous if your portfolio includes several properties or homes in different states.

Stessa’s free rent collection service makes payments and deposits more efficient for both tenants and property owners, eliminating the need for third-party tools. The integrated rental application, tenant screening, and eSigning features create a straightforward and hassle-free leasing process.

The platform also offers advanced tax resources. Filing taxes becomes less complicated, while rental property insurance helps ensure you have enough protection against potential risks.

Lastly, Stessa provides users with a dynamic community forum. It’s a thriving hub where real estate investors share tips and questions about Stessa and offer up their expertise, know-how, and passion for investing.

Cons

Though Stessa provides many tools and features, it doesn’t currently handle maintenance requests and tenant communications. That could be a drawback for landlords searching for a more comprehensive “in the weeds” property management solution.

TurboTenant overview

TurboTenant is a landlord platform designed to streamline rental property management tasks. The software offers features like property listings, rent collection, and tenant screening. It also has an affordable price tag, making it an option worth considering for DIY landlords.

Pricing structure

TurboTenant offers three pricing plans: Free, Pro, and Premium.

The Free plan has all the basic features, while the paid plans are for landlords requiring more from property management software. Pro costs $119 per year, and the Premium plan costs $149 per year.

Features summary

- Unlimited property listings and advertising on syndicated listing sites like Rent.com, Apartments.com, and Realtor.com

- Online rent collection with automated late fee application and payment reminders

- Customizable tenant application forms

- Thorough tenant screening with credit, eviction, and criminal history checks

- Customizable state-specific lease agreement templates

- Integrated accounting software with downloadable financial reports and tax schedules (requires a paid REI HUB subscription)

- Online maintenance requests and management feature

- In-app messaging feature to ease communication with prospective tenant leads

- Lead management dashboard for efficient tracking of prospective tenants

- Document management feature, allowing upload and storage of vital documents

- Automatic pre-screening to help landlords make fast decisions based on tenants’ basic information like income levels and whether they have pets

Pros

Key TurboTenant features include a rent estimate report and an in-depth analysis of local market trends, which aid in setting competitive rental prices. The platform also allows landlords to customize late fee charges, giving them additional control over revenue.

Premium users also benefit from included access to features that Free plan users pay for a la carte, like state-specific lease agreements and addenda and a Landlord Forms Pack with property inspection reports and move-in/move-out condition documents. All paid subscribers can also use calculators for ROI, rent-to-income ratio, and prorated rent.

Cons

Compared to the paid plans, the Free plan has certain drawbacks. These include increased tenant screening and ACH rent payment fees, restricted tenant screening data, slower customer support responses, and lease agreements and forms that are only accessible through paid options. Landlords who opt out of the paid upgrade may find these individual expenses adding up over time.

Choosing between these two platforms

Choosing between Stessa and TurboTenant largely depends on your distinct needs and preferences. Both platforms offer unique features and benefits, so knowing how they differ can help you make an informed decision.

TurboTenant, designed for DIY landlords, has a comprehensive suite of features, such as property listings, rent collection, and tenant screening. It also has affordable plans, with a free and paid option. However, Free plan users may find the costs associated with some individual features and limited customer support to be a disadvantage.

Stessa has finance tools tailored to residential rental property owners with no limit on the number of properties in your portfolio. Users can opt for the free Essentials plan or access more advanced features through the Pro plan.

Stessa’s strength lies in its unlimited property tracking, document storage, landlord banking services, customizable financial reports, tenant screening, and online rent collection. However, it currently lacks some day-to-day property management features like vacancy marketing and maintenance request management.

TurboTenant may be more appealing to landlords willing to pay more for a one-stop shop for managing properties and communicating directly with tenants. Stessa could be a better fit for those more focused on financial automation, advanced reporting, and optimizing the performance of their real estate investments.

To learn more about Stessa, visit the website here.

*Stessa is not a bank. Stessa is a financial technology company.Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.