Stessa and RentRedi are two of the top solutions in the rapidly evolving world of property management software. Each has a suite of tools to help landlords simplify critical tasks, such as tenant screening, rent collection, income and expense tracking, financial reporting, and more.

What exactly does each platform offer, and how do they stack up from the perspective of residential property owners and real estate investors?

This in-depth comparison dives into both services’ key features, strengths, and weaknesses. Let’s begin with this brief overview table, summarizing the main offerings of these two platforms:

|

Stessa |

RentRedi |

|

| Key features |

|

|

| Pricing |

|

|

| Unique advantages |

|

|

| Limitations | Not a complete property management solution (no capability for handling maintenance requests, tenant communications, or lease agreements) |

|

| Final takeaway | Greater focus on helping real estate investors track financial transactions and optimize property investments | Greater focus on property management tasks, including listing and marketing properties and a communication portal |

How Stessa and RentRedi work

Both Stessa and RentRedi offer unique solutions tailored to landlords’ needs.

Stessa is designed for residential real estate investors and provides comprehensive accounting tools that track income, expenses, and key performance metrics across all properties. It also offers an added benefit of free landlord bank accounts for each rental.

RentRedi is a multifaceted platform featuring tools for listing and marketing properties, tenant screening, rent collection, and maintenance requests, meant to streamline the entire rental management process.

Stessa overview

Stessa, a Roofstock company, gives residential real estate investors a specialized accounting platform to track the performance of their properties. It efficiently categorizes income and expenditure transactions according to the IRS Schedule E and generates financial summaries with minimal effort, eliminating physical documents and paperwork.

Stessa serves both novice landlords and seasoned investors, handling an unlimited number of properties. With an emphasis on working to enhance your investments, the software integrates with your financial accounts and property management applications, instantly offering you a detailed fiscal snapshot of your portfolio.

Over the past year and a half, Stessa has expanded its features to encompass tenant applications and screening, eSigning (available with the paid Stessa Pro plan), rent collection, landlord banking, and document storage. Its mobile applications for iOS and Android ensure you stay linked to your portfolio from virtually anywhere and offer an automated receipt scanning function, which is especially useful during tax season.

Pricing structure

Stessa’s tiered pricing model accommodates a variety of needs and budgets:

| Essentials | Manage | Pro |

|

|---|---|---|---|

| PRICING | |||

| Free | $15/month ($12/mo when paid annually) | $35/month ($28/mo when paid annually) |

|

| ASSET MANAGEMENT | |||

| Track properties | Unlimited | Unlimited | Unlimited |

| Dashboards | Key metrics only | Key metrics only | Full chart history |

| Property manager connections | Unlimited | Unlimited | Unlimited |

| Document & receipt storage | Unlimited | Unlimited | Unlimited |

| Organize & manage portfolios | 1 | 1 | Unlimited |

| Shared account access | Yes | Yes | Advanced ownership metrics |

| BOOKKEEPING/ACCOUNTING | |||

| Advanced transaction tracking | No | No | Yes |

| Smart receipt scanning | 5/month | 5/month | Unlimited |

| Manual expense tracking | Yes | Yes | Yes |

| Automated bank feeds | Unlimited | Unlimited | Unlimited |

| Budgeting & pro-forma analysis | No | No | Yes |

| Project expense tracking | No | No | Yes |

| REPORTING & TAXES | |||

| Reporting level | Basic | Basic | Advanced |

| Full data export | Yes | Yes | Yes |

| Accountant tax package | Basic | Plus Schedule E | Plus CapEx |

| BANKING | |||

| High yield Cash Management | 2.67% APY* | 2.67% APY* | 4.32% APY* |

| FDIC insured up to $2.5M/entity | Yes | Yes | Yes |

| No minimum balance | Yes | Yes | Yes |

| 1.1% cash back on purchases | Yes | Yes | Yes |

| ONLINE RENT COLLECTION | |||

| Accelerated rent payments | No | Yes | Yes |

| Automated reminders and late fees | Yes | Yes | Yes |

| Tenant autopay | Yes | Yes | Yes |

| Tenant ledger and rent roll | Yes | Yes | Yes |

| Tenant ACH fee waived | No | No | Yes |

| LEASING | |||

| Vacancy advertising | Yes | Yes | Yes |

| Syndication to Zillow | Yes | Yes | Yes |

| Tenant applications & screening | Yes | Yes | Yes |

| Lease template | No | Yes | Yes |

| DOCUMENT MANAGEMENT | |||

| eSign leases, contracts, etc. | No | 1/month | 7/month |

| 60+ Forms and templates | No | Yes | Yes |

| CUSTOMER SUPPORT | |||

| Basic support | Yes | Yes | Yes |

| Priority chat support | No | Yes | Yes |

| Live phone support | No | No | Yes |

| Get Started | Get Started | Get Started |

You can always start with the Essentials plan and upgrade to a paid plan as your portfolio expands and your needs evolve.

Features summary

- Automated income and expense tracking: Organizes and categorizes transactions automatically from connected bank, lender, credit card, and property management accounts with no extra fee or add-on required.

- Real-time performance metrics: Get 24/7 visibility into your portfolio’s performance.

- Financial reporting: Generate income statements, net cash flow reports, balance sheets (with the paid Stessa Pro plan), and more.

- Property management integration: Connect to your property management software for a complete portfolio summary.

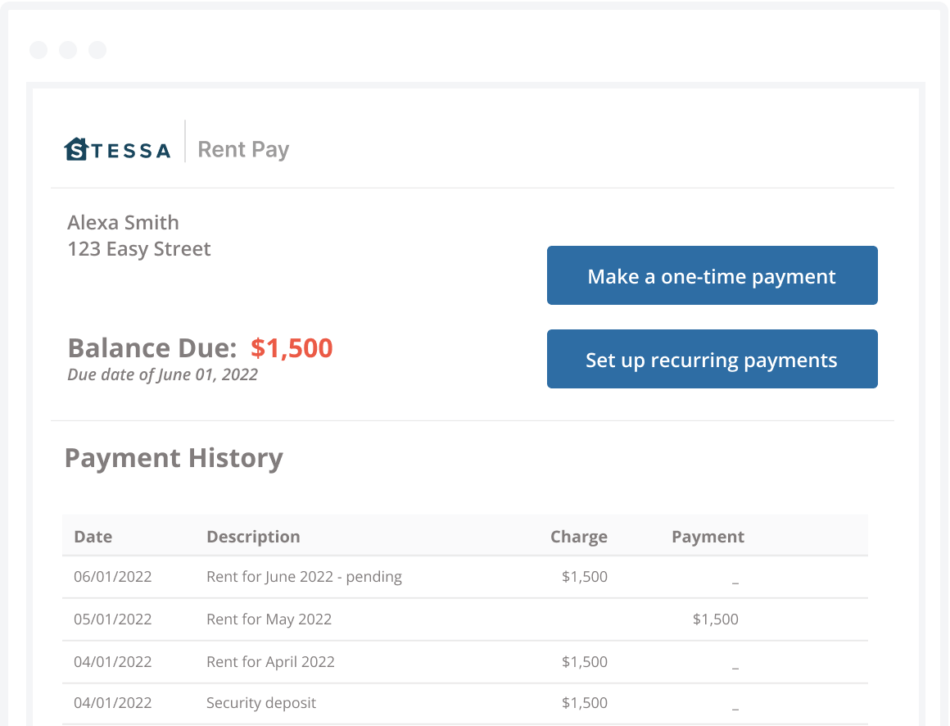

- Free rent collection: Collect rent through ACH payments, free for property owners and tenants.

- Landlord banking: Open an FDIC-insured checking account for each property and seamlessly integrate it with Stessa’s financial tracking features.

- Unlimited properties: Add an unlimited number of properties.

- Collaborative access: Invite other investors with different access levels.

- Data security: Use industry-leading encryption to keep your data safe and secure.

- Insurance quotes: Get insurance quotes and policies for rental properties within Stessa from Steadily, a tech-enabled national landlord insurance provider.

- Tax resources: Access a suite of tax resources created in partnership with The Real Estate CPA.

- Rental applications and tenant screening: Use Stessa’s tenant screening tool and free rental applications.

- eSigning: Upload documents, tag them for digital signatures, and send them to tenants, vendors, partners, and more.

Pros

Stessa boasts many unique benefits, making it a robust and comprehensive tool for residential real estate investors. It delivers a holistic snapshot of your investment portfolio, a feature many landlords appreciate.

By offering real-time performance indicators and automated income and expense monitoring, Stessa equips property owners with a precise understanding of their financial status at any given moment. This crystal-clear transparency is crucial to decision-making and strategizing future investments.

The platform’s user-friendly capability to directly interface with your property management software and financial accounts saves you the significant time and labor of manual data entry. The unlimited properties feature is especially beneficial for those managing multiple properties in several states.

Stessa’s free rent collection service does away with the need for add-ons, making rental payments easier for both tenants and landlords. The built-in eSigning rental application and screening tools add another layer of ease, simplifying the tenant selection process.

Accessing tax resources and landlord insurance quotes within the platform helps you tackle the more advanced aspects of property ownership, such as tax filing and securing adequate coverage against risks.

Lastly, Stessa users can connect and network in an active community forum, which allows real estate investors to exchange skills, knowledge, and interests.

Cons

Although Stessa equips property owners with an array of tools and features, it currently does not handle routine tasks such as maintenance requests or tenant communication. This limitation may lead landlords to seek a property management solution that includes those functions.

RentRedi overview

RentRedi is an all-in-one property management software with user-friendly features for landlords and tenants.

Founded to focus on simplifying rental management, the company offers an affordable web portal and mobile app to screen tenants, receive rent payments, and manage property maintenance virtually anywhere.

While many of these features are common to other property management systems, RentRedi aims to set itself apart by putting landlords first.

Pricing structure

RentRedi’s pricing starts at $19.95 per month. The platform offers a variety of subscription packages, including a monthly plan priced at $19.95, a 3-month plan at $15 per month, and an annual plan that costs $108 per year (or $9 per month ). Each RentRedi subscription allows an unrestricted range of tenants, properties, team members, listings, and round-the-clock customer support.

Features summary

- Property listing on popular sites including Zillow and Realtor.com

- Online tenant application

- Thorough tenant screening

- Online lease signing

- Rent payment collection through cash, credit, or ACH

- Automated payment reminders and receipts

- Landlord option to block or allow partial rent payments

- Rental property accounting (requires a paid REI Hub subscription)

- Link multiple bank accounts

- Maintenance management feature

- Online document storage and sharing capabilities

Pros

RentRedi offers several features for residential landlords. Its integration with Zillow and Realtor.com allows for syndicated property listings on these widely-used sites.

The platform also simplifies the application process using online submissions and extensive screening tools, which can expedite the tenant selection process.

Other features help you organize property management tasks, including rent payment collection options and online document storage, with a maintenance management feature and rental property accounting available at an extra cost.

Cons

To access rental property accounting, landlords need an REI Hub subscription, which ranges from $15/month for 3 units up to $99/month for unlimited units. After paying for this feature, you can generate various financial reports and Schedule E for tax reporting.

The property management feature also requires a paid monthly subscription to Latchel after a 30-day trial. The extra cost is $15/month per unit for emergency service 24/7 or $25/month per unit for full maintenance coordination.

While landlords can conveniently collect rent payments from tenants online, they can take up to 5 business days to become available. Additionally, if tenants choose to make their rent payments through the mobile app, the landlords’ funds could be on hold for as long as 7 business days before they’re accessible.

The final verdict

Stessa and RentRedi both offer a range of user-friendly tools designed to simplify the landlord’s job.

RentRedi provides an all-in-one approach, with numerous features from rent collection and tenant screening to maintenance management and integration with popular property listing sites. However, some of its add-ons, like premium maintenance services and rental property accounting, come at an extra monthly cost.

A significant advantage of Stessa is its free rental property accounting feature, custom-built for rental property owners, in contrast to RentRedi’s paid add-on service.

The Stessa platform provides automated income and expense tracking, instant reports for tax season, and real-time performance metrics. Tailored to rental property owners, Stessa offers vital real estate metrics crucial for informed investment decision-making.

Stessa also provides advanced portfolio optimization tools and banking services, including FDIC-insured accounts with a competitive APY and a cash management debit card. Its subscription option, Stessa Pro,has even more advanced features like budgeting, project expense tracking, eSigning, unlimited receipt scanning, and full data export.

Though both platforms cater to residential landlords, Stessa’s focus on financial and asset management, plus its free rental property accounting, might make it the preferred choice for novice and sophisticated real estate investors.

Visit the website to learn more about how Stessa helps rental owners and operators manage their portfolios like the pros.

*Stessa is not a bank. Stessa is a financial technology company. Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.