If you’re a rental property owner or real estate investor, you know how important it is to have good software to help you manage your business. There are a lot of different options out there, so it can be tough to decide which one is right for you.

In this blog post, we’ll do a side-by-side comparison of 2 of the most popular software options: Stessa and Landlord Studio.

Stessa overview

Stessa, a Roofstock company, offers cloud-based software that helps real estate investors maximize profits through smart money management, automated income and expense tracking, personalized reporting, and more.

The company was launched in 2016 by 2 experienced real estate investors with 30 years of combined experience. Stessa was built with the investor in mind to take care of monitoring and analyzing details, so you don’t have to. More than 200,000 investors already use Stessa to track their properties with more than $60 billion in asset value.

Landlord Gurus, a website that provides expert advice to residential landlords and property managers, ranked Stessa as the #1 accounting software for landlords in 2023. Criteria used to determine the rating included income and expense tracking, reporting and bank account integration, and tax preparation.

Stessa was acquired by Roofstock, a leading marketplace for buying and selling single-family rental (SFR) properties, in March 2021. The Roofstock platform lets everyone from first-time investors to global asset managers evaluate, purchase, and own residential investment properties with confidence from anywhere in the world.

Pricing

The Stessa Essentials plan lets landlords use its primary features at no cost. Users can create as many properties and bank accounts as needed, generate unlimited financial reports, and export their transaction data to Excel as often as they like.

For access to more advanced features, Stessa’s tiered pricing structure offers a variety of features for different budgets and needs:

| Essentials | Manage | Pro |

|

|---|---|---|---|

| PRICING | |||

| Free | $15/month ($12/mo when paid annually) | $35/month ($28/mo when paid annually) |

|

| ASSET MANAGEMENT | |||

| Track properties | Unlimited | Unlimited | Unlimited |

| Dashboards | Key metrics only | Key metrics only | Full chart history |

| Property manager connections | Unlimited | Unlimited | Unlimited |

| Document & receipt storage | Unlimited | Unlimited | Unlimited |

| Organize & manage portfolios | 1 | 1 | Unlimited |

| Shared account access | Yes | Yes | Advanced ownership metrics |

| BOOKKEEPING/ACCOUNTING | |||

| Advanced transaction tracking | No | No | Yes |

| Smart receipt scanning | 5/month | 5/month | Unlimited |

| Manual expense tracking | Yes | Yes | Yes |

| Automated bank feeds | Unlimited | Unlimited | Unlimited |

| Budgeting & pro-forma analysis | No | No | Yes |

| Project expense tracking | No | No | Yes |

| REPORTING & TAXES | |||

| Reporting level | Basic | Basic | Advanced |

| Full data export | Yes | Yes | Yes |

| Accountant tax package | Basic | Plus Schedule E | Plus CapEx |

| BANKING | |||

| High yield Cash Management | 2.45% APY* | 2.45% APY* | 4.23% APY* |

| FDIC insured up to $2.5M/entity | Yes | Yes | Yes |

| No minimum balance | Yes | Yes | Yes |

| 1.1% cash back on purchases | Yes | Yes | Yes |

| ONLINE RENT COLLECTION | |||

| Accelerated rent payments | No | Yes | Yes |

| Automated reminders and late fees | Yes | Yes | Yes |

| Tenant autopay | Yes | Yes | Yes |

| Tenant ledger and rent roll | Yes | Yes | Yes |

| Tenant ACH fee waived | No | No | Yes |

| LEASING | |||

| Vacancy advertising | Yes | Yes | Yes |

| Syndication to Zillow | Yes | Yes | Yes |

| Tenant applications & screening | Yes | Yes | Yes |

| Lease template | No | Yes | Yes |

| DOCUMENT MANAGEMENT | |||

| eSign leases, contracts, etc. | No | 1/month | 7/month |

| 60+ Forms and templates | No | Yes | Yes |

| CUSTOMER SUPPORT | |||

| Basic support | Yes | Yes | Yes |

| Priority chat support | No | Yes | Yes |

| Live phone support | No | No | Yes |

| Get Started | Get Started | Get Started |

You can always start with the Essentials plan and upgrade to a paid plan as your portfolio expands and your needs evolve.

Software features

- Track unlimited properties (single-family, multifamily, and short-term rentals).

- Automate income and expense tracking by linking bank and mortgage accounts.

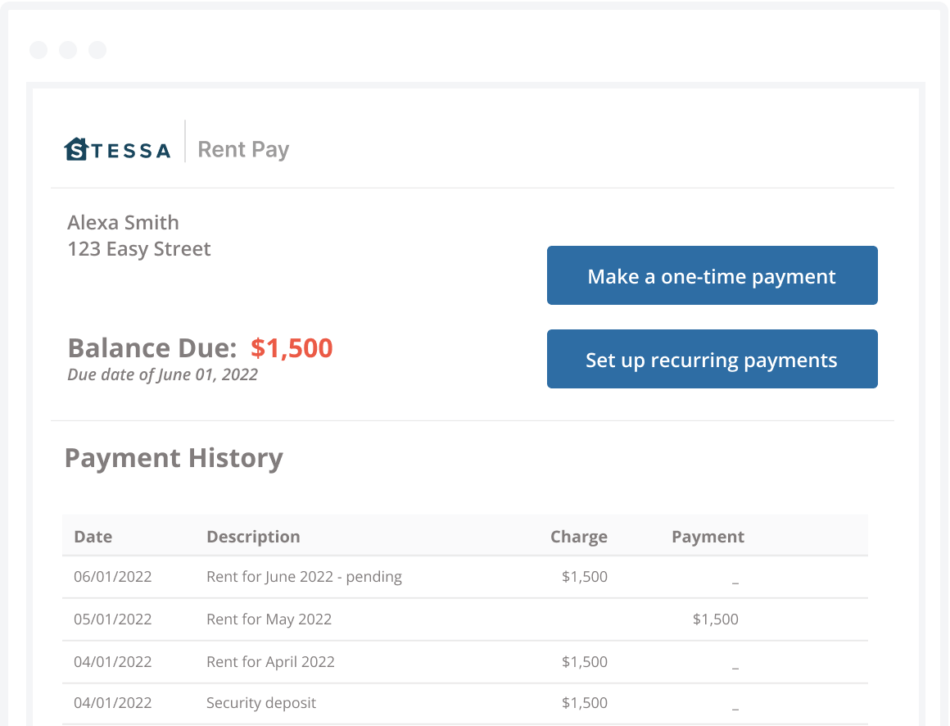

- Collect rent online with Automated Clearing House (ACH) payments from tenants and convenient automatic reminders.

- Landlords can perform tenant screening on Stessa through RentPrep and handle rental applications within the platform.

- Get comprehensive performance dashboards at the portfolio and property levels.

- Publishing a vacancy for rent and syndicate your listing across a variety of websites for maximum exposure to high quality tenants.

- Access your portfolio from anywhere, 24/7.

- Run monthly income-statement, net-cash-flow, capital expense, and other reports.

- Collaborate with partners and family.

- Organize and store all your real estate documents, invoices, and payment receipts.

- Track expenses on the go with the iOS and Android apps.

- Export tax-ready financials and get access to the Stessa Tax Center (makes tax time a breeze).

Go here to create a free Stessa account.

Landlord Studio overview

Landlord Studio is a cloud-based software system that helps landlords with marketing vacant rental property, screening tenants, collecting rent, accounting, and tax readiness. It also stores documents for multiple rental properties.

The company was founded in 2015 and offers desktop and mobile applications.

Pricing

Landlord Studio offers a free 14-day trial, after which you can choose from one of two pricing plans, with month-to-month or annual billing options.

- GO plan: Free for the first 3 units

- PRO plan: Priced at $15/month (or $12/month when billed annually) for 3 units, with prices increasing by $1/month/unit for each additional unit managed on the platform.

Software features

GO

- Track up to 3 properties

- Online rent collection ($2.50 for each transaction, paid by the tenant)

- Automated late fees

- Desktop, iOS, and Android apps

- Manual income and expense tracking

- Mileage tracking

- Basic reports

- Tenant screening

- Tenant portal with maintenance tracking

PRO

Includes all of the features of the GO plan, plus:

- Advanced reporting

- Multiuser access (up to 5 users)

- Bank feed integration

- Smart receipt scanner

- Automated rent reminders

- Unlimited document storage

- Custom email templates

- Integration with Xero

Stessa vs. Landlord Studio

Here’s a summary of some essential features landlords typically need in a property management platform, along with an overview of how Stessa and Landlord Studio solve for them.

Listings

Stessa offers online listings, making it easy to publish a vacancy for rent. Stessa syndicates your listings to Zillow’s family of websites for maximum exposure to high quality tenants.

With Landlord Studio, owners create a property listing page on the site, then manually place the link on the rental listing websites of their choice. The link can also be used for social media, brochures and flyers, and email marketing campaigns.

Tenant screening

Landlords can perform tenant screening on Stessa through RentPrep and handle rental applications within the platform.

Landlord Studio uses TransUnion to generate background checks, credit reports, and criminal and eviction checks. The company charges a $40 report fee that can be paid by the landlord or passed on to the applicant.

Leasing

Stessa offers tailored leases and other key legal forms in the paid Pro plan, with 60+ legal docs and eSigning via DocuSign. Landlord Studio does not currently offer lease signing.

Both companies have options for organizing and storing lease documents online. Stessa provides free unlimited document storage while paying subscribers to Landlord Studio can upload and store up to 10 documents on the website.

Online rent collection

Stessa and Landlord Studio both offer online rent collection. Landlord Studio charges tenants a fee of $2.50 for each online rent transaction. On the other hand, ACH rent payments with Stessa are free of charge.

Property owners can collect the monthly rent with both companies, plus one-time fees, such as a security deposit, prorated rent, or late fees. Tenants can also set up an automatic rent payment to ensure the rent is paid on time.

Financial reporting

Stessa provides a full range of financial reports for free, including an income statement, net cash flow, capital expense reports, tenant rent roll, real estate balance sheet with owner’s equity, and a Stessa Stress Test model to run various rent collection scenarios across your portfolio.

Landlord Studio offers a variety of reports in both CVS and PDF formats, such as profit and loss, income and expenses, occupancy, overdue and upcoming expenses, mileage, reminders, and tenant rent roll.

Tax management

Both Stessa and Landlord Studio track income and expenses using Internal Revenue Service (IRS) Schedule E categories to help make tax reporting more straightforward.

The Stessa Tax Center is free for users and includes a personalized year-end tax package with an income statement, net-cash-flow report, and a ZIP file in a single email.

All of the subscription plans from Landlord Studio offer the option of generating a Schedule E report that provides the information needed to fill out Schedule E for Form 1040 at the end of the year.

Stessa vs. Landlord Studio: Which is best for your needs?

Landlord Studio offers a variety of features to help landlords manage their rental properties, including the ability to collect rent online and track income and expenses for tax purposes. However, the company charges a monthly subscription fee once you want to manage over 3 properties on their platform.

Stessa has a free tier that offers landlords a wide variety of features for unlimited units. For landlords that need more advanced features, the Pro plan offers more access to more of the robust tools.

By offering landlords a choice, Stessa can stay focused on providing landlords with the best online rent collection, reporting, and accounting tools. The software is ideal for real estate investors who own SFRs, small multifamily properties, short-term vacation rentals, and entire rental property portfolios.

*Stessa is not a bank. Stessa is a financial technology company. Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.