Landlords using the right software can automatically categorize expenses, generate professional reports, and handle the day-to-day tasks of property management with minimal effort.

Stessa and Buildium stand out as leading solutions, but their dramatic differences in pricing and feature sets leave many investors wondering which platform truly fits their needs. While Stessa offers robust free features focused on financial optimization, Buildium’s paid platform aims to handle every aspect of property management.

This detailed comparison helps you understand exactly what you get with each platform.

How Stessa and Buildium work

Stessa and Buildium provide rental property accounting and management software solutions for real estate investors. In fact, both companies are listed in Investopedia’s 2022 review of the best accounting software for rental properties.

Stessa is ranked #1 for providing the best value for rental property owners and managers. The company’s cloud-based software is free and can be used by both novice and experienced real estate investors to track an unlimited number of residential rental properties and portfolios.

Buildium is ranked #1 as the best rental property accounting software for large property portfolios. The company offers both monthly and annual subscription plans with prices varying based on the number of units and management and the desired services.

Stessa overview

Stessa rental property financial management software is free and designed for both novice and sophisticated real estate investors. The software works with SFRs, residential multifamily properties, and short-term vacation rentals.

Stessa was founded in 2016 and is used by over 200,000 rental property owners with a combined total of over $60 billion. The company was acquired by Roofstock, a leading online investment marketplace for buying and selling SFR homes.

According to Investopedia, Stessa provides the best value for rental property accounting software, while Landlord Gurus rates Stessa as the best overall accounting and financial tracking software.

Pricing

The Stessa Essentials plan lets landlords use its primary features at no cost. Users can create as many properties and bank accounts as needed, generate unlimited financial reports, and export their transaction data to Excel as often as they like.

For access to more sophisticated features, Stessa’s tiered pricing structure offers a variety of features for different budgets and needs:

| Essentials | Manage | Pro |

|

|---|---|---|---|

| PRICING | |||

| Free | $15/month ($12/mo when paid annually) | $35/month ($28/mo when paid annually) |

|

| ASSET MANAGEMENT | |||

| Track properties | Unlimited | Unlimited | Unlimited |

| Dashboards | Key metrics only | Key metrics only | Full chart history |

| Property manager connections | Unlimited | Unlimited | Unlimited |

| Document & receipt storage | Unlimited | Unlimited | Unlimited |

| Organize & manage portfolios | 1 | 1 | Unlimited |

| Shared account access | Yes | Yes | Advanced ownership metrics |

| BOOKKEEPING/ACCOUNTING | |||

| Advanced transaction tracking | No | No | Yes |

| Smart receipt scanning | 5/month | 5/month | Unlimited |

| Manual expense tracking | Yes | Yes | Yes |

| Automated bank feeds | Unlimited | Unlimited | Unlimited |

| Budgeting & pro-forma analysis | No | No | Yes |

| Project expense tracking | No | No | Yes |

| REPORTING & TAXES | |||

| Reporting level | Basic | Basic | Advanced |

| Full data export | Yes | Yes | Yes |

| Accountant tax package | Basic | Plus Schedule E | Plus CapEx |

| BANKING | |||

| High yield Cash Management | 2.31% APY* | 2.31% APY* | 3.98% APY* |

| FDIC insured up to $2.5M/entity | Yes | Yes | Yes |

| No minimum balance | Yes | Yes | Yes |

| 1.1% cash back on purchases | Yes | Yes | Yes |

| ONLINE RENT COLLECTION | |||

| Accelerated rent payments | No | Yes | Yes |

| Automated reminders and late fees | Yes | Yes | Yes |

| Tenant autopay | Yes | Yes | Yes |

| Tenant ledger and rent roll | Yes | Yes | Yes |

| Tenant ACH fee waived | No | No | Yes |

| LEASING | |||

| Vacancy advertising | Yes | Yes | Yes |

| Syndication to Zillow | Yes | Yes | Yes |

| Tenant applications & screening | Yes | Yes | Yes |

| Lease template | No | Yes | Yes |

| DOCUMENT MANAGEMENT | |||

| eSign leases, contracts, etc. | No | 1/month | 7/month |

| 60+ Forms and templates | No | Yes | Yes |

| CUSTOMER SUPPORT | |||

| Basic support | Yes | Yes | Yes |

| Priority chat support | No | Yes | Yes |

| Live phone support | No | No | Yes |

| Get Started | Get Started | Get Started |

You can always start with the Essentials plan and upgrade to a paid plan as your portfolio expands and your needs evolve.

Feature summary

- Automated income and expense tracking: Organize and categorize transactions automatically from connected bank, lender, credit card, and property management accounts with no extra fee or add-on required.

- Financial reporting: Generate income statements, net cash flow reports, balance sheets (with the paid Stessa Pro plan), and more, all within the platform.

- Real-time performance metrics: Get 24/7 visibility into your portfolio’s performance with no third-party software required.

- Property management integration: Connect to some property management software platforms for a complete portfolio summary.

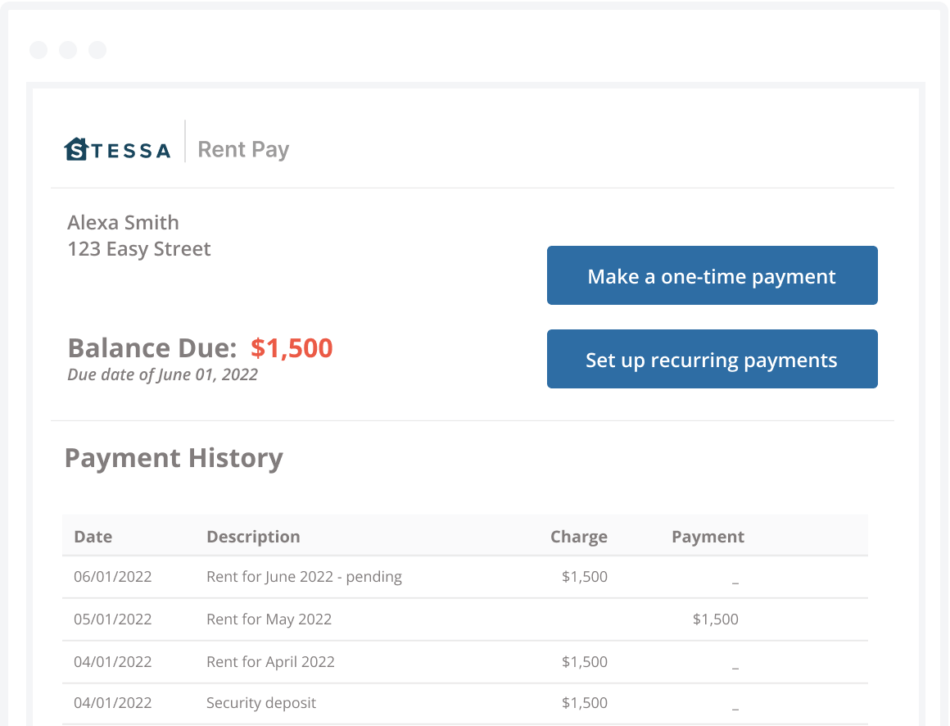

- Online rent collection: Automate your rent collection process, including payment reminders and late fees, reducing the likelihood of missed or late payments.

- Advertise vacancies: Publish a vacancy for rent and syndicate your listing out to a variety of websites for maximum exposure to high quality tenants.

- Rental applications: Manage tenant applications efficiently and effectively by streamlining the process of publishing vacancies and collecting and reviewing applications.

- Landlord banking: Open FDIC-insured bank accounts and enjoy a more efficient way to manage your property-related finances. You can earn more than 10x the national average interest rate on every dollar deposited.*

- Tenant screening: Use a proprietary approach with RentPrep for comprehensive tenant checks, including a full credit report, background check, and more. Landlords can also add screening for income verification or of judgment and liens, increasing the odds of selecting reliable tenants.

- Unlimited properties: Add as many single-family homes, short-term vacation rentals, or multifamily units as you like.

- Tax center: Tax time is a cinch thanks to the Stessa Tax Package feature. It helps aggregate your transactions and sends you personalized tax reports via email with digital copies of all of your receipts packaged into a single ZIP file.

- eSigning (partnered with DocuSign): With the Stessa Pro plan, you can upload up to five documents monthly, mark them for electronic signatures, and send them to tenants, vendors, and partners.

- Smart receipt scanning: Add expense receipts to your transactions ledger quickly and accurately via mobile scans and email forwarding, reducing the risk of losing or misplacing vital receipts.

Pros

Stessa is designed for both novice and experienced real estate investors with SFRs, multifamily units, and/or short-term vacation rentals.

The software is intuitive and easy to use with no complicated onboarding required. After signing up for a free account, simply enter a property address, link bank and mortgage accounts, and begin monitoring rental property performance in real time.

Income and expense transactions are automatically recorded to the chart of accounts, and unlimited financial reports—such as income and net cash flow statements, capital expenses, tenant rent rolls, and real estate balance sheets with owner’s equity—can be generated with just a click.

Stessa also makes it easy for tenants to pay on time, and automate key tasks like deposits, receipts, and accounting. Stessa online rent collection is a win-win and is free for both landlords and tenants.

Go here to create a free Stessa account.

Cons

There are some features that the company currently doesn’t provide, such as a tenant portal for making maintenance requests or receiving notices.

Buildium overview

Investors and property managers with up to 5,000 units may wish to take a closer look at Buildium. The company’s property management software is designed to work with residential properties, student housing, affordable housing, and community associations.

Buildium was launched in 2004 and had more than 14,000 customers by 2017. In December 2019, Buildium was acquired by RealPage, a multinational corporation that provides residential and commercial real estate property management software solutions.

According to Investopedia, Buildium is ranked as the best accounting software of 2022 for large property portfolios.

Fee structure

Buildium offers 3 plans with pricing that varies based on features and the number of units under management. All plans include modules for Resident & Board Member Communications, Maintenance, Tasks, Violations, Online Portals, and Accounting, along with a free marketing website.

All Buildium plans also come with a free, 14-day trial and a discount for an annual subscription.

Essential

The Essential plan is designed for portfolios with up to 150 units. Pricing currently begins at $58 a month for 1 to 20 units, and goes up to $256 a month for 150 units. The plan includes:

- Basic tenant screening

- Standard reporting

- Customer support via online ticket

The Essential plan also offers other products and services for an additional fee:

- Property inspections starting at $40 a month

- eSignatures at $5 a signature

- Online payments at $1.99 for each incoming electronic funds transfer (EFT) and $0.50 for each outgoing EFT

- Credit card fee of $2.99% per transaction

- Bank account set-up fee of $99 per account

Growth

The Growth plan is designed for portfolios with up to 5,000 units. Pricing currently begins at $183 a month for 151 units and goes up to $5,900 a month for 5,000 units. The plan includes all of the items in the Essential plan, plus:

- Premium tenant screening

- Performance Analytics and Business Analytics and Insights reports

- Free property inspections

- Unlimited eSignatures

- Ticket and live phone customer support

- Bank account set-up fee free for first 5 accounts, then $99 per account

- Online payments at $0.60 for each incoming EFT and $0.50 for each outgoing EFTs

- Credit card fee of 2.99% per transaction

- Onboarding fee required for customers with more than 20 units

Premium

The Premium Package ranges from $375 a month for up to 150 units to $12,000 a month for 5,000 units. Investors or property managers with more than 5,000 units in a portfolio can contact the company for specific pricing.

All of the features of the Essential and Growth plans are included in the Premium plan, plus:

- Open API

- Buildium Rewards (provides discounts based on residents’ usage of services through Buildium)

- Priority customer support

- Dedicated growth consultant for new client leads

- Onboarding fee required for customers with more than 20 units

- Fee for incoming EFT waived

Buildium software features

Leasing

- Listings

- Applications

- Showing coordinator

- Tenant screening

- Professional website

- eSignature

Business operations

- Owner and resident portals

- Maintenance request tracking

- Property inspections

- Renters insurance

- Document storage

- Analytics and insights

- Open API

Accounting

- Online payments

- Retail cash payments for tenant rent

- Property accounting

- Company financial reporting

- 1099 eFiling

Pros

Buildium may be a good fit for investors and property managers with large rental property portfolios of up to 5,000 units, due to the recurring subscription fees that Buildium charges.

Investors seeking a full suite of property management tools may find that Buildium is worth the price. Buildium software provides features such as tenant screening and online rent payments, owner and resident portals for maintenance requests and notices, property inspections, and eSignatures for leases and addendums.

Cons

Because the software is designed for larger portfolios, real estate investors with smaller rental property portfolios may find that Buildium is too expensive, especially for a few units.

While Buildium does include valuable features, such as tenant screening and online rent payments, companies such as Cozy and TenantCloud also provide these services for free or for a minimal fee.

Stessa vs. Buildium: How to choose?

Both Stessa and Buildium aim to make owning and managing rental property easier by providing accounting and financial management software solutions.

Buildium uses a subscription pricing model, with prices currently ranging from $58 a month to $12,000 a month, depending on the number of units in a portfolio, services, and features. Buildium is a good match for large investors, property managers, and community associations.

On the other hand, Stessa was designed to offer powerful accounting and property management tools to rental property owners at the lowest possible cost. Stessa is free to get started, with affordable paid plans for landlords who w antmore advanced features.

*Stessa is not a bank. Stessa is a financial technology company. Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.