A rent ledger is a document that records the complete payment history of each tenant.

Rent ledger transactions can be handwritten on a paper form, manually entered into a spreadsheet, or automatically updated by syncing a bank account to a rental property financial management software like Stessa.

In addition to tracking rent receipts, a rent ledger also provides information about a tenant, including their history of on-time or late payments, past due amounts, security deposit collected, and the start and end date of their lease.

3 ways to create a rent ledger template

You can build a rent ledger from scratch using a downloadable, printable form or a spreadsheet program—or automatically create one using free online software for rental property financial management.

Printable rent ledger template

Keeping track of rent payments is essential when you’re managing rental properties. That’s why we’ve put together an easy-to-use rent ledger template for you.

It’s a handy spreadsheet template created in Google Docs, so you can easily print it out anytime. The template is perfect for anyone, whether you’ve been handling properties for years or are just getting started.

Grab our printable rent ledger template here to help make your property management tasks easier.

Rent ledger template using a spreadsheet

A rent ledger template created using spreadsheet software, such as Excel, Numbers, Sheets, or OpenOffice, is the next step up from a printable form. Most landlords likely already use spreadsheet software for other tasks.

Here’s what a basic tenant ledger template looks like using Google Sheets, along with a link to download a free customizable rent ledger spreadsheet template:

Assembling a rent ledger template in a spreadsheet may take a little extra time and effort. However, once the design work is complete, a spreadsheet is much easier to customize than a form created by somebody else, and printing a spreadsheet with a tenant’s rent history also has a much more professional appearance.

Unfortunately, tenant information and rent payment transactions still need to be manually entered on a spreadsheet rent ledger. Data entry opens the door to errors, and there may be better things for a landlord to do with their time than record monthly rent payments on a spreadsheet.

Automated rent ledger with Stessa

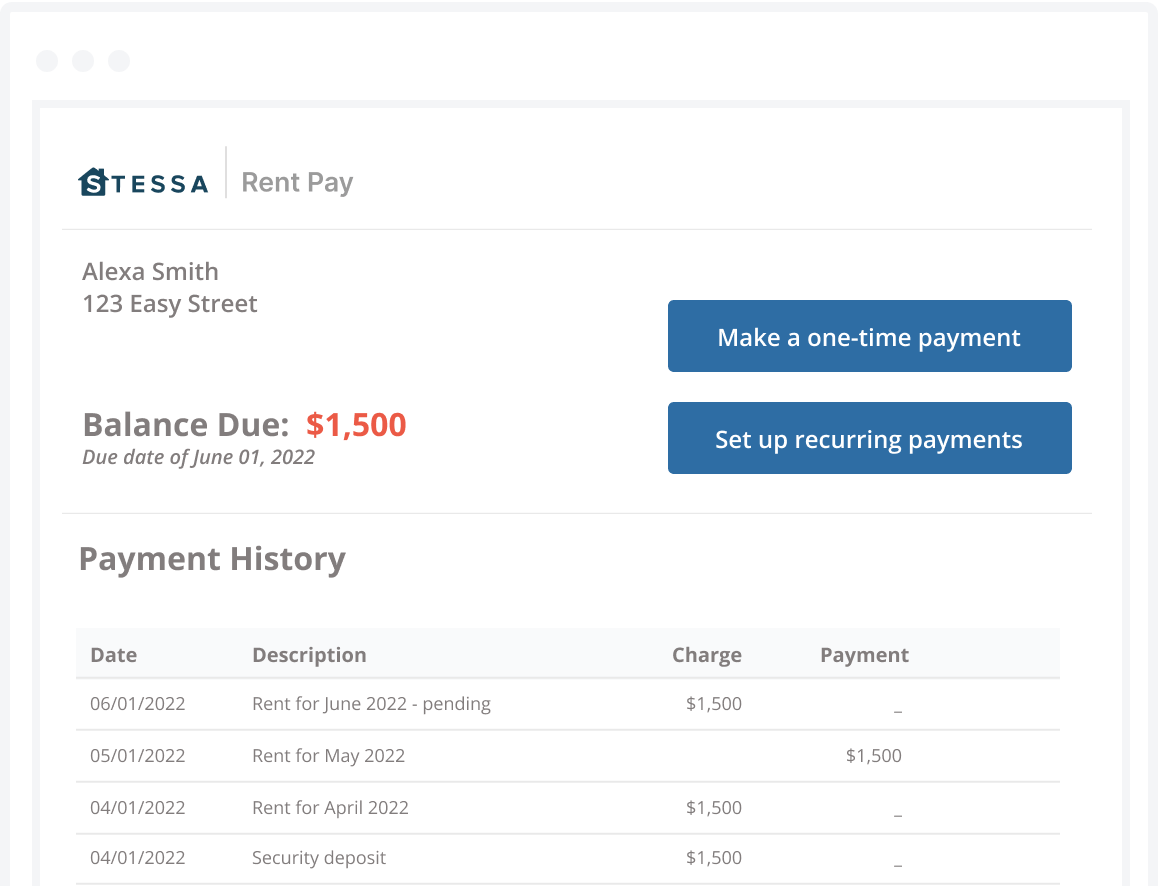

Signing up for a free account with Stessa is an easy way to automate your rent ledger and track each tenant’s charges, payments, and balances.

Stessa makes it easy for a tenant rent ledger to run on autopilot because, in most cases, neither monthly rent charges nor payments require manual entry into the ledger:

- Rent charges get added automatically to the rent ledger on the first day of each month.

- Payments appear when monthly rent is received, are automatically recorded as income, and get assigned to a specific property or unit and tenant.

- There are options for manually entering one-time charges and payments received, such as tenant reimbursements for damage caused by the tenant.

The beauty of Stessa’s system is its ability to automate the rent collection process. With auto-reminders for tenants and the capability to automatically apply late fees, it ensures that rent collection is timely and consistent.

However, managing a rental property involves keeping track of numerous financial transactions alongside collecting monthly rent. Using the automated rent ledger from Stessa makes it much easier to track several different tenant charges in one place, including partial rent payments, late charges, security deposits, utility pass-throughs, or repair credits.

For transactions that aren’t straightforward rent payments, such as utility pass-throughs or repair credits, Stessa allows landlords to easily add these charges directly to the tenant’s ledger. That ensures all financial interactions between you and your tenants are recorded and easily accessible. This comprehensive tracking is invaluable for both day-to-day management and long-term financial planning.

This level of automation extends to tracking every transaction related to your rental property. Stessa keeps everything documented accurately in one place, providing landlords with a software solution to manage multiple tenant charges efficiently and maintain an organized ledger.

Stessa’s rent collection feature also integrates seamlessly with its accounting tools, making it easier to balance your books with less hassle. Since the system updates your records as soon as rent arrives, you always have an up-to-date view of your property’s financial health. This integration not only saves time but can also help you make informed decisions about your property portfolio.

Security is another cornerstone of Stessa’s rent collection feature. With multi-layer encryption and robust access controls, you can enjoy peace of mind knowing that Stessa has taken steps to keep you and your tenants’ data secure. This high level of security, plus the convenience of managing rent payments through Stessa’s mobile app for iOS and Android from virtually anywhere, creates a streamlined and low-stress process.

Naturally, any automated rent collection system must also benefit tenants. That’s why Stessa offers a tenant-friendly platform. Features like ACH payments, autopay after the first successful transaction, and a clear ledger of past charges and payments encourage on-time payments. Designed to be inviting and easy to use, tenants can start using Stessa Rent Pay upon receiving an email invitation from their landlord.

Benefits of using a rent ledger

Using a rent ledger helps landlords treat their rental property as a business by staying organized, tracking the income a property generates, quickly spotting whether a tenant is behind on the rent, and catching any disparities between budgeted rental income and the actual amount of rent collected.

Here are some of the primary reasons landlords and property managers use rent ledgers…

Payment history

View the entire rental payment history of each tenant and property or unit at a glance.

Lease beginning and ending date

Monitor the end date of a lease to discuss lease renewals and rent increases with current tenants before the expiration date or begin marketing for a new tenant to keep vacancy rates low.

Late payments

Quickly identify if a tenant is late with the rent so you can contact the tenant and send an automatic reminder notice.

Late fee notice

Determine whether you can charge a late fee and when to send a late fee notice.

Document rent payment history

Access complete documentation of a tenant’s rent payment history should a dispute arise or if you need to start eviction proceedings.

Security deposits

Document the amount of refundable and nonrefundable security deposits and additional rent collected for pets or roommates to minimize landlord-tenant disputes and make a move-out easier.

Monitor revenue generated

Monitor the rental income for each of your properties and your entire property portfolio to maximize property performance and your return on investment (ROI), make refinancing easier, and have financial records on hand when financing the purchase of additional rental properties.

Items to include on a rent ledger template

A good rent ledger allows a landlord to customize information for each tenant, property, and/or unit in a multifamily building.

For example, a landlord with one rental property may only require basic information about the tenant and payment history. However, a landlord with several homes in a rental property portfolio may want to include more detailed information, such as property type, size, and notes about the property or tenant.

Many rent ledgers contain the following items:

- Owner or property manager name

- Property name, often used by landlords with multiple rental properties

- Property address and details, such as number of beds and baths, square footage, and lot size

- Tenant names on the lease and contact information

- Names of other occupants, such as minors or pets

- Lease start and end dates

- Original date the tenant moved in to monitor lease renewal history

- Monthly rent amount and due date

- Additional rent amounts, such as pet or roommate rent

- Amount of rent collected, date rent is received, and how payment was made, such as an online Automated Clearing House (ACH) transfer to a landlord’s bank account or by personal check

- Security deposit amount and whether the deposit is refundable or nonrefundable

- Late fees due for rent not paid in full by the due date, including a grace period allowance if required by local landlord-tenant law

- Amount of any unpaid balance and how long the rent is in arrears to determine when to initiate eviction proceedings if a landlord chooses to do so

- Additional notes, such as discussions or correspondence with a tenant and items in the property that need repair or replacement at the next lease renewal or tenant turnover

The difference between a rent ledger and a rent roll

As we’ve discussed, a rent ledger is essentially a detailed record of all transactions between the landlord and each tenant. It tracks the complete payment history, including rent received, partial payments, late fees, security deposits, and any other charges or credits related to the tenancy.

This document can vary in form, from a simple handwritten ledger to a sophisticated digital record automatically updated through financial management software like Stessa. The rent ledger provides a comprehensive view of a tenant’s monetary interactions with the property, highlighting their payment habits, outstanding balances, and the duration of their lease.

What is a rent roll?

On the other hand, a rent roll is a report that provides a snapshot of a rental property’s current financial performance. Unlike the rent ledger, which reflects the payment history of each tenant, the rent roll aggregates essential financial data across all the property’s units.

A rent roll includes the tenant’s name, unit number, lease start and end dates, monthly rent amount, and the total income generated from the property. The rent roll is an invaluable tool for landlords and property managers to assess their property’s overall profitability and occupancy rate at any given time.

Rent ledger vs. rent roll

While both the rent ledger and the rent roll are crucial for effective property management, they serve different purposes:

- Rent ledger: This account tracks each tenant’s historical payment activity, helping landlords monitor their renters’ financial obligations and payment behavior over time. This level of detail is vital for addressing disputes, evaluating tenant reliability, and managing individual tenant accounts.

- Rent roll: Offering a high-level overview of a property’s current financial health, a rent roll helps landlords and investors gauge the property’s income-generating performance. This way, they can make informed decisions about property management, financing, and investment opportunities.

While the rent ledger zooms in on the details of tenant transactions, the rent roll zooms out to give a broader picture of the property’s financial status.

Both documents complement each other. The rent ledger provides the granular details necessary for day-to-day management, and the rent roll offers a strategic overview helpful for long-term planning and analysis.