One of the biggest concerns nearly every landlord has at one time or another is getting a tenant to pay their rent on time.

Online rent collection tools can help eliminate the risk of late rent payments, with features such as mobile apps to make a rent payment, recurring billing for rent, automatic debiting of a checking account or debit card, and notifications of late and missed rent payments.

We’ve compiled a list of the top online rent collection tools currently available to landlords. Whether you’re just getting started as a landlord or you’ve been doing it for years, this list will help you figure out which tool is right for your needs and budget.

Looking for an easy way to collect rent and other monthly fees from your tenants? Make it easy for tenants to pay on time and automate key tasks like deposits, receipts, and accounting. Stessa online rent collection is a win-win and is free for both landlords and tenants.

10 things to look for in a rent collection tool

A good rent collection tool should allow you to collect rent online from all of tenants in one place. It should also be easy to use and allow tenants to pay their rent with a credit card or debit card. Additionally, you want something that will provide you with detailed reports so they can track their rental income and expenses.

Here are 10 key features to look for when choosing an online rent collection tool:

- Deposit Options: Modern payment methods like ACH and card payments offer convenience, allowing tenants to pay anytime, anywhere.

- Funding Times: Quick funding times are crucial, with the best rent collection tools offering access to funds within 5 business days.

- Landlord Fees: Select rent collection tools do not charge landlords fees, facilitating worry-free online rent collection.

- Tenant Fees: It’s beneficial to use a rent collection tool that doesn’t charge tenants fees to encourage timely and complete payments.

- Autopay Option: An autopay feature ensures rent is paid on time, improving cash flow and reducing late payments.

- Late Fees: Tools that automatically charge late fees help maintain timely payments and offset revenue loss from delays.

- Built-in Banking: Integrating rent collection with your checking account simplifies management and enhances reporting capabilities.

- Security: High security in rent collection tools is essential to protect tenants’ sensitive information.

- Real-time Updates: Rent collection tools offering real-time updates improve tracking and tenant relationships through convenience and transparency.

- Accounting Integration: Integration with accounting systems simplifies financial tracking and dispute resolution, crucial for property management.

11 best online rent collection tools and apps

For landlords and real estate investors, collecting rent online is crucial. There are many online rent collection tools and apps available. This section will review 5 popular tools and apps for online rent collection.

1. Stessa

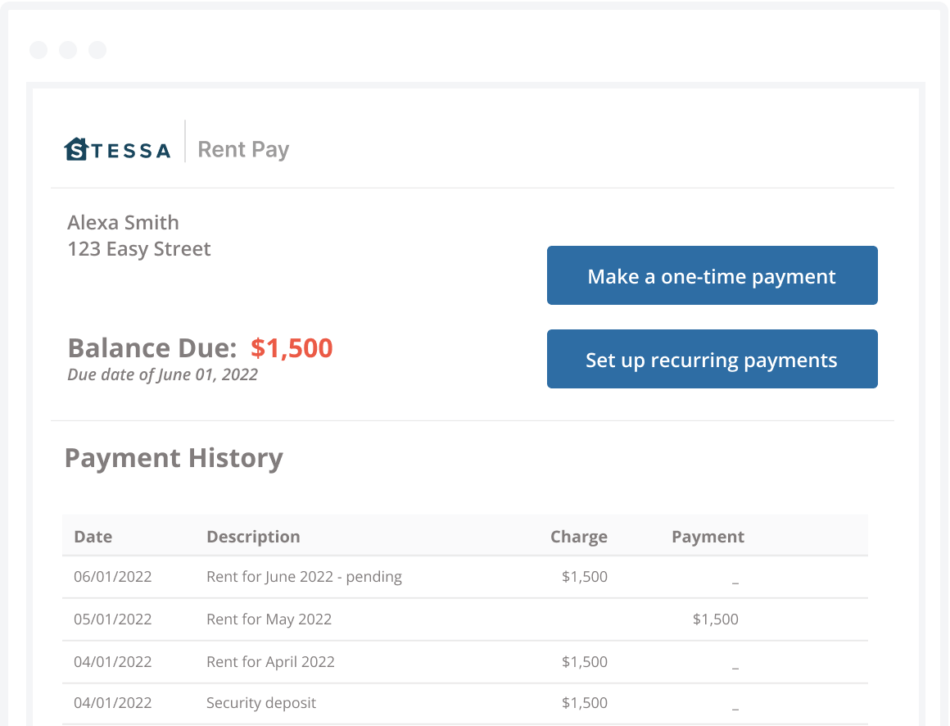

Stessa is a great option for managing your rental property. It’s easy to use and lets you collect rent online, track expenses, and generate performance reports. Plus, its comprehensive online dashboard makes it simple to keep an eye on how your property and portfolio are doing.

Stessa’s Rent Collected feature is a useful way for landlords to automate rent collection, including things like depositing rent checks, charging late fees, and tracking payments for financial reporting. There are no fees for tenants or landlords, and Stessa has robust security measures in place to keep everyone safe and secure.

With Stessa, investors who open a Stessa Cash Management deposit account can further streamline their property management with online rent collection. As an added benefit, Stessa’s Cash Management deposit accounts currently earn interest well above the national average on checking accounts.

Here’s a quick overview of Stessa’s online rent collection functionality:

- Deposit type: ACH

- Deposit times: 2 to 5 business days

- Landlord fees: None

- Tenant fees: None (on certain paid accounts, see pricing here)

- Autopay: Yes

- Late fees: Yes

- Real-time notifications: Yes

- Automatic accounting: Yes

- Accelerated rent payments: Yes (on certain paid accounts)

For those who need it, Stessa also offers a range of other features used by over 200,000 property owners:

- Property tracking: Monitor properties and portfolios, including single-family rentals, residential multifamily assets, and even short-term rentals.

- Income and expense tracking: Automate your income and expense tracking by linking your bank, credit card, and mortgage accounts.

- Rental applications and comprehensive tenant screening: Use Stessa’s tenant screening tool and free rental applications.

- Vacancy marketing: Publishing a vacancy for rent and get it syndicated to a variety of websites for maximum exposure to high quality tenants.

- Performance dashboards: Access detailed performance dashboards at both the portfolio and property level to understand key metrics like cash-on-cash return, NOI, and loan-to-value.

- Monthly reports: Generate regular reports, including income statements, net cash flow reports, capital expenses, and tenant rent rolls.

- Streamlined tax reporting: Assign income and expenses according to Schedule E to simplify your year-end tax reporting.

- Real estate balance sheet: Maintain a real estate balance sheet that periodically updates property values, mortgage balances, and owner equity.

- Mobile app: Scan receipts and track expenses on the go with highly-rated iOS and Android apps.

- Document organization: Organize and store all your real estate documents, invoices, and payment receipts in one place.

- Tax-ready financials: Export tax-ready financials and access the Stessa Tax Center for assistance during tax time.

- eSigning: Upload documents, tag them for digital signatures, and send them to tenants, vendors, partners, and more.

Go here to create a free Stessa account.

2. Avail

Avail is another excellent option for collecting rent online. It offers a simple platform for landlords to collect and track rent payment history. It also has a mobile app for iOS and Android that makes it easy for tenants to pay their rent on the go. However, Avail charges tenants a fee to make rental payments each month, which may discourage some from paying the rent online.

3. Azibo

There are several pros and cons to using the Azibo rent collection tool to collect rent online. On the plus side, there are no landlord fees, and the system provides real-time updates and seamless accounting. However, one of the potential drawbacks to Azibo is that tenants are charged a fee for using a debit or credit card to pay the monthly rent.

4. Baselane

Baselane is another option to consider when choosing an online rent collection app. Like Stessa, the service offers an all-in-one financial platform for rent collection, banking, and bookkeeping. However, Baselane charges tenants a fee for paying the rent with a credit or debit card and does not offer an integrated cash management system.

5. TurboTenant

TurboTenant may be a good choice for those who want a comprehensive solution for managing their rental properties. The software offers some of the features that Stessa does, including thorough user verification and ACH rent payments. On the other hand, accounting integration may be limited, making it more challenging to track rental property performance in real time.

6. ClickPay

A landlord can collect 100% of rent payments remotely with ClickPay’s online platform. Features include online payments, lockbox and check scanning, e-billing, and walk-in payment solutions. The company’s Invitation Wizard sets new tenants up in a matter of minutes, while landlord bank deposit reports make monthly reconciliations easier.

7. eRentPayment

The company provides landlords and tenants with flexible online rent payment options including one-time and recurring rent payments, credit card processing, and customizable settings for late fee assessments. A landlord can block partial rent payments, and tenants can build a credit history by reporting rent payments.

Visit the eRentPayment website

8. PayYourRent

Landlords can receive same day rent payment processing, while tenants build their credit history with each rent payment. Tenants can pay a security deposit and the monthly rent by credit card or eCheck, and landlords get same-night rent deposits directly into their bank accounts. Other services from PayYourRent include rental applications, tenant screening, and maintenance requests.

9. TrueRent

TrueRent offers free ACH online rent collection and recurring billing to help increase income. The company’s QuickPay feature notifies a tenant when the rent is due, and rent payments are deposited directly into a landlord’s bank account. Late fees are automatically generated when a tenant is past due, and a new invoice is sent to a tenant showing the new total amount due including monthly rent and late fees.

10. Buildium

The company claims to cut rent payment processing time by up to 70% when tenants add a bank or credit card account set up for recurring payments. Funds are automatically transferred to a landlord’s bank account, eliminating the need for a manual deposit. Buildium software also offers a full suite of property management services, including accounting, maintenance request tracking, rental listings, and tenant screening.

11. PayRent

The company helps to make collecting rent more predictable for landlords and paying rent more rewarding for tenants. RentDefense offers an exclusive set of payment controls to help ensure on-time rent payments, while RentCred is a rewards program for tenants with reports sent to credit bureaus when the rent is paid on time.