Collecting and keeping track of rent payments is an important part of being a landlord, and having a good system in place can make the job easier and less prone to errors.

In this article, we’ll look at ways to track tenant rent payments and explain why some methods for accepting rent may be better than others. Let’s begin by discussing why rent receipts are important for keeping track of payments.

Key takeaways

- A good system for tracking rent payments creates a trail to prove rent was received and to minimize discrepancies between landlords and tenants.

- Rent payment receipts are written or electronic documents that track tenant rent payments by showing the date rent was received, the amount of rent paid, and any outstanding balance.

- Landlords may track rent payments manually using a rent payment ledger, with spreadsheet programs, or automatically online or with software.

How to use a rent receipt

A rent receipt is a written or electronic document that proves the rent was paid.

By providing a tenant with a receipt, a landlord can better avoid potential conflict with a tenant regarding rent payment, help reconcile a bank account, and create a trail. Some local and state landlord-tenant laws may require a landlord to provide a tenant with a rent receipt.

Information on a rent receipt should include:

- Tenant name

- Property address

- Date rent was paid

- Amount of rent payment received

- Person receiving the rent payment

- Late fees included in payment (if applicable)

- Method of payment (cash, check, credit or debit card, Automated Clearing House (ACH) transfer)

- Balance due after payment received

3 top ways to track rent payments

While a rent receipt provides proof that the rent was paid, landlords still need to have a system in place to keep track of rent payments. A rent payment system can be manual, created with a spreadsheet, or automated by syncing a bank account with software for rental property accounting.

1. Manual rent ledger

A ledger is a logbook used to manually keep track of rent payments. Also known as a second book of entry, the format of a ledger includes columns for transaction dates, account titles and details, and debit and credit amounts.

Using a manual rent ledger requires a basic knowledge of double-entry accounting. For example, assume a landlord receives a monthly rent payment of $1,500. The funds are debited to the landlord’s bank account to increase the balance on the real estate balance sheet and credited to rental income to increase the amount of income on the income (profit and loss) statement.

The rent receipt given to the tenant when the rent is paid serves as backup to the manual entry in the rent ledger.

2. Spreadsheet for rent payments

A spreadsheet is an electronic version of a manual rent ledger. Software such as Microsoft Excel, Apple Numbers, Google Sheets, and Apache’s OpenOffice Calc can be used to create a spreadsheet for rent payments.

Landlords also can find free or low-cost worksheet templates online that are already designed to keep track of rent payments.

For example, this income and expense worksheet resource has a free Excel spreadsheet template designed for up to 5 rental properties or units in a multifamily building. In addition to keeping track of rent payments, the spreadsheet can be used to track monthly operating expenses and tenant security deposits.

One of the biggest drawbacks to using a spreadsheet for rent payments: they still need to be manually entered. A rent payment spreadsheet template also does not use double-entry accounting, which means a landlord will still need to make manual debit and credit entries to record rental income and increase a bank account balance when rent payments are received.

3. Automated software

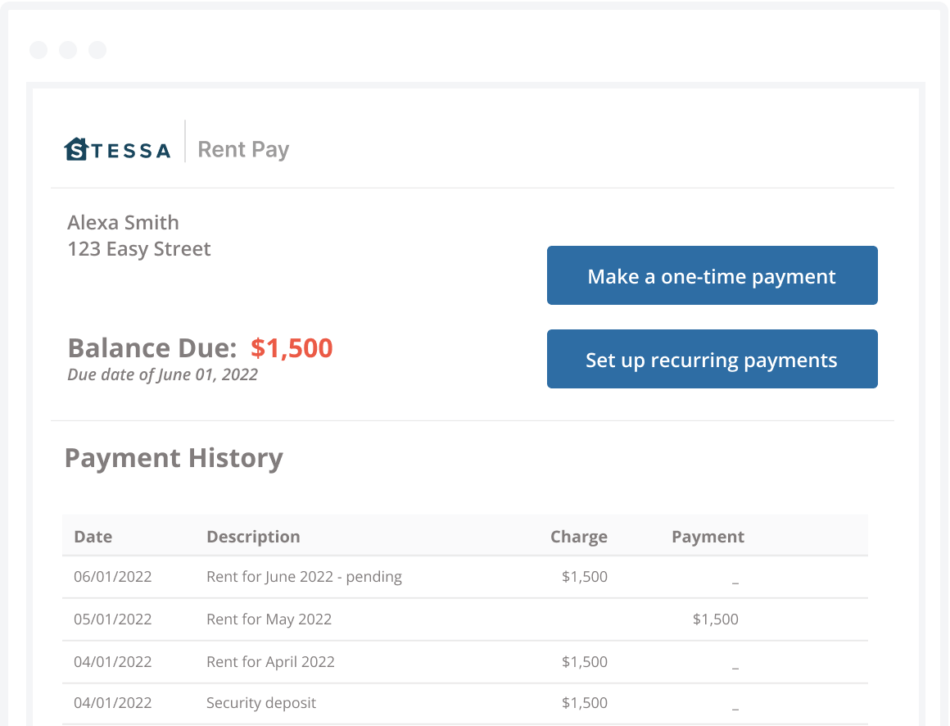

Using free rental property financial software from Stessa, a Roofstock company, lets landlords ditch manual journal entries and spreadsheets by automatically tracking rent payments and expenses.

Rather than wasting time and energy manually writing rent receipts and tracking rent payments, rent tracking software from Stessa automates back-office tasks so that landlords have more time to focus on their businesses rather than bookkeeping.

Rent payments are credited to the correct tenant and property, and general journal entries are automatically updated for accurate income statements and real estate balance sheets. When a rent payment is received, a landlord’s checking account is debited for the rent received, the profit and loss (P&L) statement is credited to increase rental income, and a trail is instantly created.

Some of the biggest benefits of automatically tracking rent payments include:

- Automation of rent payment tracking by linking and syncing bank accounts

- Generation of a tenant rent ledger showing real-time information of rent received and past-due balances for each tenant, property, and portfolio.

- Tracking of tenant leases and organization of tenant records securely online with free data storage

- Creation of key financial reports, such as income statements and rent rolls, to share with business partners, lenders, or other real estate investors

- Ability to export tax-ready financials to streamline return preparation when tax time rolls around

Choosing how you should collect rent

It’s possible to track any type of rent payment. However, landlords may find that some methods for collecting and tracking the monthly rent are better and easier than others.

Here are some of the main ways to collect rent from tenants, along with the pros and cons of each:

Cash

A cash rent payment can be collected by a landlord or property manager in person at the property or by using a third-party drop-off location near the property.

Accepting a rent payment in cash may be a viable option for a landlord who is house-hacking by renting out part of an owner-occupied home or the next-door unit of a multifamily property. But, generally speaking, accepting rent payments in cash may create more problems than advantages.

Cash rent payments can be hard to track because they don’t show up in a tenant’s bank account as a withdrawal for rent. There also may be discrepancies between the rent a tenant claims to have paid and the amount a landlord records as being received.

Check

Rent payments by check are accepted by many landlords. One advantage to receiving a rent payment by check is that a tenant can postdate and mail a check to make sure that the rent is paid on time.

There are some drawbacks to accepting checks for the rent. A check doesn’t necessarily mean that a tenant has money in their bank account. If the check bounces, a landlord may be charged a bounced check fee.

Also, some tenants simply are not used to writing checks. Millennials and Zoomers, 2 large demographic groups that frequently rent rather than own, may prefer to do as much as possible online.

Direct deposit

Paying rent by direct deposit or email transfer is a good alternative to receiving rent payments by cash or check.

Most banks allow a tenant to make an ACH transfer to send money directly from their account to a landlord’s bank account, or offer services like Zelle using an email address or mobile phone number.

Rent payments made by direct deposit are much easier to keep track of and automatically create a digital record for both landlord and tenant if there are ever any discrepancies. Potential disadvantages to direct deposit is that there is normally a small fee involved, and a tenant must also have a bank account from which to send the rent money.

Online rent payment

Online rent payment services are frequently the option of choice for collecting and keeping track of rent payments.

Stessa’s rent collection feature makes it easy for tenants to pay on time, and it automates key tasks like deposits, receipts, and accounting. You can also offer tenants the ability to set up recurring ACH payments – so they never miss a deadline (options for additional payment methods are coming soon). It’s a win-win, and it’s free for both landlords and tenants.

Many online rent payment platforms automatically generate rent reminder notices, assess late fees, prohibit partial rent payments, and report on-time rent payments to the major credit bureaus, providing an incentive for tenants to pay the rent on time.

Closing thoughts

Keeping track of rent payments is an important part of owning and operating rental property, and required by the IRS to accurately report income and expenses. While there are a variety of ways to track rent payments, using Stessa to automatically track income and expenses may give landlords more time to focus on maximizing profits to get the most out of their investments.