Single-family rent price growth in the U.S. recently hit another record, increasing by 12.6% year over year. According to a press release from CoreLogic (March 15, 2022), all major metro areas covered by the company experienced year-over-year rent increases.

That means the question many landlords will face is not if the rent should be increased, but when. In this article, we’ll review how much notice to give a tenant for a rent increase, list free online tools for determining fair market rent, and discuss what to include in a rent increase notice.

Key takeaways

- Landlords are generally required to notify tenants of rent increases 30 to 60 days before the end of the lease.

- Local and state landlord-tenant laws may regulate how much notice is required for a rent increase.

- Landlords often use rent comparables and online tools to determine the fair market rent before sending notice of a rent increase.

When can a landlord increase the rent?

When a landlord can increase the rent depends on the type of lease and local and state landlord-tenant laws.

If a tenant is on a long-term lease, a landlord typically must wait until the end of the lease to increase the rent. On the other hand, if a tenant is renting month to month, in most cases a landlord must give a tenant a 30-day notice prior to the beginning of the month the rent increase will go into effect.

How much notice is required for a rent increase?

Local and state landlord-tenant laws regulate how much notice must be given to a tenant before the rent can be increased.

The legal resource website Nolo.com maintains a page with links to the landlord-tenant laws for each state. Landlords also may wish to consult with a local residential real estate attorney or property management company to learn more about real estate laws in specific rental property markets.

Here are some general rules to follow when giving a tenant notice that the rent will be increased:

Month-to-month lease

A 30-day notice must be given to a tenant before raising the rent. In most cases, the rent increase notice must be received by the tenant 30 days before the beginning of the month the rent is to be increased. For example, if a landlord wishes to raise the rent on a month-to-month lease beginning August 1, notice must be given to the tenant prior to July 1.

Download a month to month lease template here.

Long-term lease agreement

If a tenant is renting on a long-term lease, such as a one-year or 2-year lease, most states require that a 30- or 60-day rent increase notice be provided to a tenant. That means if a lease expires July 31, notice must be received by the tenant 30 to 60 days before the end of July.

Some landlords who offer long-term leases of more than a year build in an annual rent increase of a predetermined amount. For example, the rent on a 2-year lease may be $1,500 per month for the first year, then automatically increase by 5% to $1,575 for the second year.

Download a long term lease template here

The advantage to both landlords and tenants is that rental income and expenses are more predictable. A landlord knows how much rental income will be received without worrying about vacancies between tenants, and a tenant knows how much to budget for rent.

However, a landlord who offers a lease of longer than a year with a built-in increase may find that fair market rent increases exceed the automatic increase in the lease. Of course, the opposite also could occur if rents in the market unexpectedly decline.

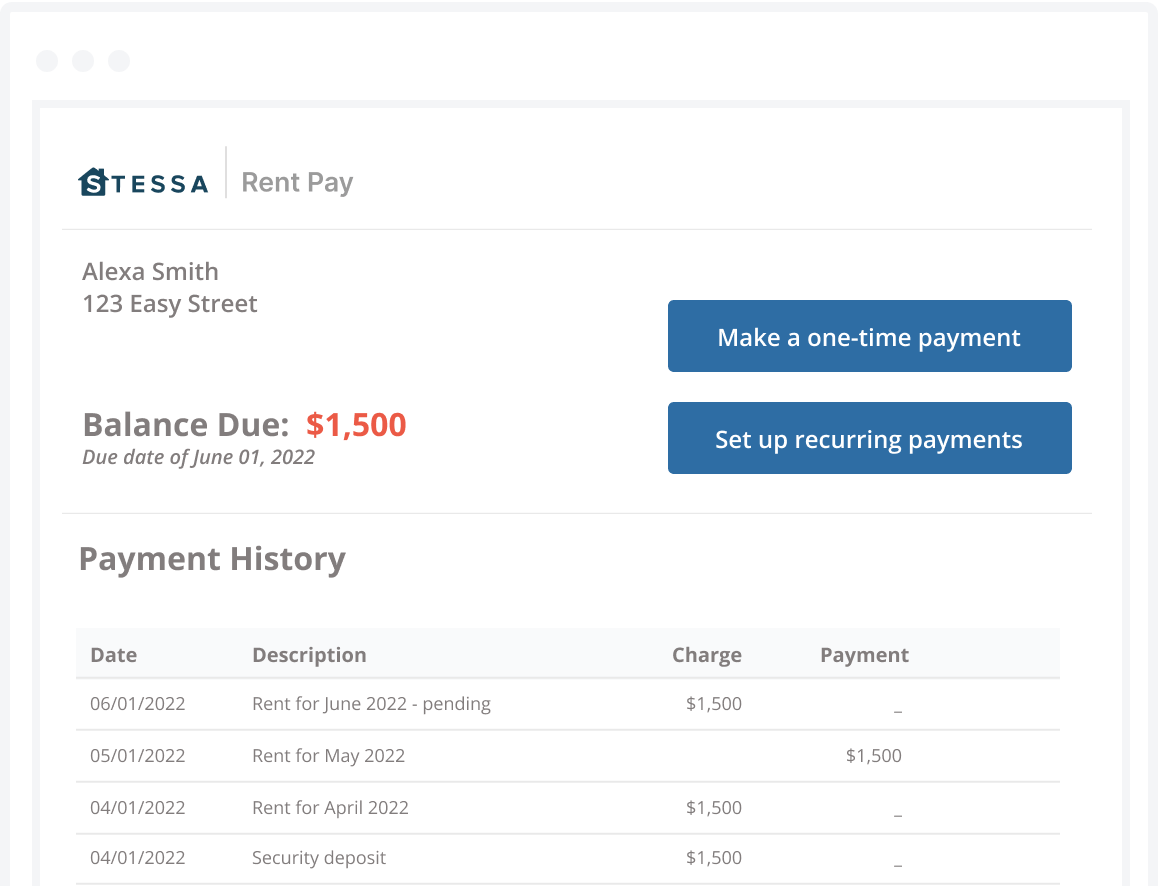

Related: Looking for an easier way to collect rent from your tenants? Check out Stessa rent collection – a free tool that makes it easy for tenants to pay on time, and automate key tasks like deposits, receipts, and accounting. Get notified when a payment is made and when it’s been deposited in your account.

Tips for calculating a rent increase

One of the potential risks a landlord faces when raising the rent is that the tenant may decide not to renew the lease. A home that sits vacant for an extended period of time before a new qualified tenant can be found doesn’t generate any rental income, but operating expenses and the mortgage still need to be paid.

That’s why it’s important to accurately determine the fair market rent prior to sending a tenant a rent increase notice. Also known as FMR, fair market rent is the monthly rent price of similar homes in the same area as the one being rented. If a rent increase is fair compared to comparable rentals, a tenant may be more likely to renew a lease with a higher rent.

Factors affecting fair market rent

Determining the fair market rent is similar to running comparables to determine the purchase price of a home. Factors that influence fair market rent include:

- Property type. Single-family rental (SFR) versus a unit in a multifamily building.

- Property size. Square footage, number of bedrooms and bathrooms, and outside space.

- Age and condition of the property. Original construction date and updates or renovations, such as a fully remodeled kitchen or bathrooms.

- Location of the property. Neighborhood rankings based on criteria such as median household income levels, school district quality, and nearby amenities, like parks, dining, and entertainment venues.

- Utilities or services included. Whether water, sewer, gas, or landscaping services are included in the rent.

Tools for calculating fair market rent

Here are tools landlords can use to help calculate the fair market rent of a property:

- Stessa Rent Estimate is an optional, premium service for Stessa users. The service identifies opportunities to increase cash flow by determining a fair asking rent based on current listings, rent comparables, and market trends.

- Rentometer offers free and paid options, ranging from $9 a month to $149 a year for comparing rent with other local properties. Investors and tenants enter basic information, such as the property address, current rent, and number of bedrooms and bathrooms, to analyze the rent.

- Zillow provides a free Rent Zestimate to help landlords determine how much to charge for rent. The online tool analyzes millions of data points and local market trends to provide a starting price point for the monthly rent.

- Property management companies are good sources for determining fair market rent.

Beware of local and state rent control laws

Some cities and states have laws that control how much the rent can be raised, if at all.

Residential rent control laws may limit the frequency and timing of rent increases, permit rent increases only in extraordinary circumstances, such as a property renovation or improvement, and limit a landlord’s ability to evict a tenant.

The National Multifamily Housing Council (NMHC) maintains a page with an interactive map of rent control laws by state.

Where to find a rent increase notice

A rent increase notice must be delivered to a tenant within the statutory timelines and signed by both landlord and tenant to show both parties agree to the rent increase.

A basic rent increase notice includes:

- Landlord and tenant name and contact information

- Property address, including unit number for a multifamily property

- Current rent and amount of new rent

- Expiration date of lease

- Required date the tenant must respond to the rent increase notice

Rent increase notice templates can be found online from websites such as LawDepot and eForms or obtained from a local residential real estate attorney, an investor-friendly real estate agent, or a local property management company.

Final thoughts

Most real estate markets today experience more demand for rental property than there is supply, with rent prices steadily increasing year after year. In most cases, a tenant probably won’t be surprised to learn that the rent is increasing at the end of the lease.

Giving proper written notice of a rent increase will give a tenant enough time to budget for a higher monthly rent, follow local and state landlord-tenant laws, and allow a landlord sufficient time to market the property if a current tenant decides not to renew the lease.