In an excellent analysis piece this week, Konrad Putzier of the Wall Street Journal (subscription required) gave us an in-depth look at how the largest technology companies in the U.S. are boosting commercial real estate. Putzier reports that:

Five of the biggest property owners in the tech industry—Amazon.com Inc., Facebook Inc., Apple Inc., Google parent Alphabet Inc. and Microsoft Corp.—together occupy around 589 million square feet of U.S. real estate…That is more than all of the office space in New York City…[and] it marks a fivefold increase from a decade ago.

Source: WSJ

Not only has big tech’s interest in commercial space been a boon for the industry, it also attracts higher-paid employees to these markets. Andy Peters of the Atlanta Journal-Constitution reported last week that that city’s council approved a 250,000 square-foot data center in South Fulton County.

The Daily Beat also reported last week that Apple just signed a lease for more office space in Manhattan’s 11 Penn Plaza. Apple added two additional floors to a recent 220,000 square foot sublease, bringing its total footprint to 336,000 square feet.

These companies are not just investing in physical real estate space, but in property technology companies as well. CRETech reported this week that both Facebook and Google invested in a $55 million Series B round in Factory_OS, a modular housing startup. The company builds components off-site and claims to lower construction costs by 20-40%.

Back to Putzier and WSJ, he notes that “The pandemic has only made these firms more dominant in real estate. While most other companies are holding off on property transactions amid uncertainty over the economy and the rising popularity of remote work, Amazon, Facebook and its peers continue to lease and buy space.”

Source: WSJ

😠 Blame the youth! … for rising home prices

Christopher Rugaber of AP News reported on the release of new S&P CoreLogic Case-Shiller 20-city home price index data last week showing a 6.6% year-over-year home price increase across the U.S. This is the result of the disruption in the spring buying season this year, which has pushed many home sales into the fall and kept demand high.

Why have prices and demand remained so high? Rugaber explains: “The number of homes for sale sank in September to the lowest level since records began in 1982, according to the National Association of Realtors. And last week mortgage rates fell to a record low of 2.72%, according to mortgage buyer Freddie Mac.”

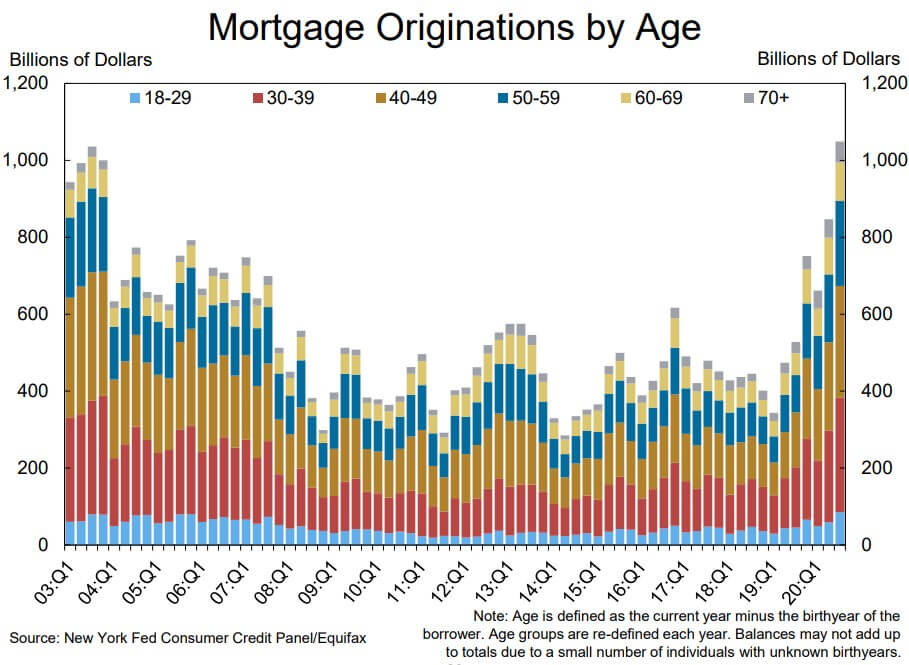

Demand is strongest among younger Americans, which has reached an all-time high according to Ben Carlson from A Wealth Of Common Sense. In 2011, buyers in their 30s accounted for 20% of all mortgages. In the last quarter, it was almost 30%. Further, “In the third quarter of 2011, there were $62.5 billion in mortgages originated for people in their 30s. In the third quarter of 2020, that number was nearly $300 billion.” As you can see in the below chart, the 30-39 age bracket makes up a larger portion of mortgage holders in the U.S.:

Source: A Wealth Of Common Sense

The National Association of Realtors (NAR) recently reported new home pricing data that shows existing home sales increased 26.6% from a year ago and the median home price now sits at $313,000, about 16% higher than in October 2019. According to NAR’s chief economist Lawrence Yun, “Considering that we remain in a period of stubbornly high unemployment relative to pre-pandemic levels, the housing sector has performed remarkably well this year.”

And, according to Redfin, interest in the cities may be seeing a resurgence with searches on its platform up 200% for urban centers year-over-year in October 2020.

Source: Redfin

For more on this topic, see Shaina Mishkin’s excellent Barron’s piece titled, Home Prices See Their Biggest Increase in 6 Years. Why the Surge Could Continue.

Compass IPO analysis

It’s been a year of major IPOs; Palantir, Asana, Lemonade, and more. But, with both Compass and Airbnb gearing up to go public, real estate watchers have a lot to look forward to. Compass has selected underwriters for its public offering, according to Gillian Tan of Bloomberg. It has certainly been a good year for real estate brokerages (see above!), of which Compass is one of the largest, whose current valuation sits at over $6 billion.

Questions still remain, as James Kleimann of Housing Wire reports: “There are also open questions about how much expansion is possible for the brokerage, which currently boasts more than 18,000 agents and sold over $91 billion worth of property in 2019.”

The Real Deal also reported on the news, noting a few interesting points

- Compass co-founders Robert Reffkin and Ori Allon have said forever an IPO was likely.

- Compass has benefitted from a quicker-than-expected housing turnaround in recent months.

- Forced to lay off 15 percent of its staff in March, the firm claimed it saw record revenue in June, July, and August.

- The IPO market has gotten hot with other real estate players lining up to go public, including Airbnb, Opendoor and Porch.com.

- Compass added independent board members including LinkedIn CFO Steve Sordello and Charles Phillips, a former president of Oracle.

Finally, GeekWire reports on the interesting rivalry between Zillow and Compass. No doubt the fact that shares of Zillow and Redfin being up 142% and 119%, respectively, in 2020 factored into Compass’ thesis around an IPO. Both located in Seattle, Zillow sued Compass last year for intellectual property theft and poaching employees. “In fact, the competition spills over to design, where the home pages of the two companies are remarkably similar.”

Now, Compass will attempt to benefit from the housing resurgence with the early 2021 IPO. Keep an eye out for the relationship between the housing market at that time and the initial performance of the stock.