One of the biggest concerns nearly every landlord has at one time or another is getting a tenant to pay their rent on time.

Online rent collection tools can help eliminate the risk of late rent payments, with features such as a mobile app to make a rent payment, recurring billing for rent, automatic debiting of a checking account or debit card, and notifications of late and missed rent payments.

We’ve compiled a list of the top rent collection apps currently available to landlords. Whether you’re just getting started as a landlord or you’ve been doing it for years, this list will help you figure out which tool is right for your needs and budget.

Looking for an easy way to collect rent and other monthly fees from your tenants? Make it easy for tenants to pay on time and automate key tasks like deposits, receipts, and accounting. Stessa’s online rent collection is a win-win and is free for both landlords and tenants.

10 Key Things to Look for in a Rent Collection Tool

A good rent collection tool should allow you to collect rent online from all of your tenants in one place. It should also be easy to use and allow tenants to pay their rent via ACH, credit card or debit card. Additionally, you want something that will provide you with detailed reports so you can track your rental income and expenses accurately.

Here are 10 key features to look for when choosing an online rent collection tool:

- Deposit Options: Modern payment methods like ACH and card payments offer convenience, allowing tenants to pay anytime, anywhere.

- Funding Times: Quick funding times are crucial, with the best rent collection tools offering access to funds within 5 business days.

- Landlord Fees: Some rent collection tools offer no and/or low-fee options on the landlord side of the transaction, helping to ensure that as much rent as possible flows through to your bottom line.

- Autopay Option: An autopay feature ensures rent is paid on time, improving cash flow and reducing late payments.

- Late Fees: Tools that automatically charge late fees help maintain timely payments and offset revenue loss from delays.

- Built-in Banking: Integrating rent collection with your checking account simplifies management and enhances reporting capabilities.

- Security: High security in rent collection tools is essential to protect tenants’ sensitive information.

- Real-time Updates: Rent collection tools offering real-time updates improve tracking and tenant relationships through convenience and transparency.

- Accounting Integration: Integration with accounting systems simplifies financial tracking and dispute resolution, crucial for property management.

Now let’s get into our list of recommended apps. We’ll start the list with our own tool, Stessa, which is currently used by over 300,000+ landlords.

The Best Rent Collection Apps for Landlords

1. Stessa

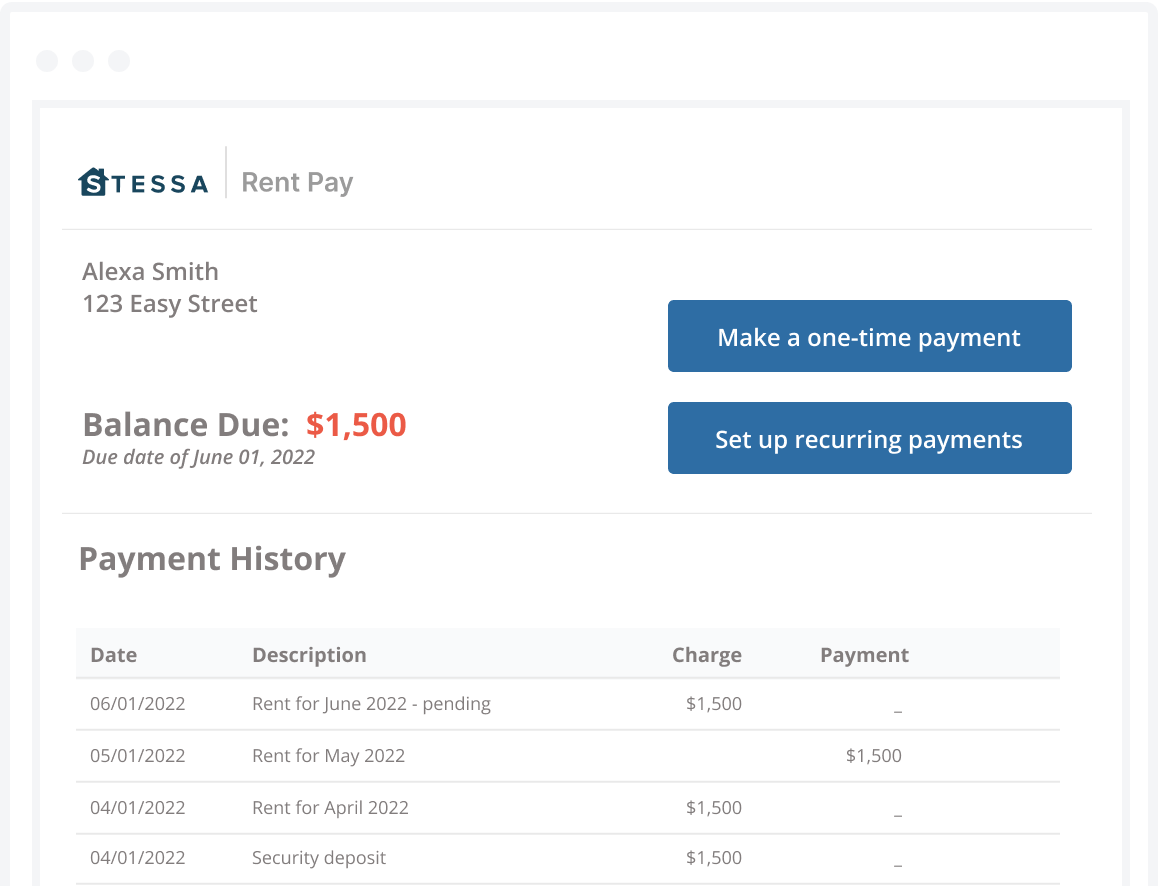

Stessa is a great option for managing your rental property. It’s easy to use and lets you collect rent online, track expenses, generate performance reports, alongside many other advanced features designed for landlords. Plus, its comprehensive online dashboard makes it simple to keep an eye on how your property and portfolio are performing.

Stessa’s Rent Collected feature is a useful way for landlords to automate rent collection, including things like depositing rent checks, charging late fees, and tracking payments for financial reporting. The system is designed to be low-friction for both tenants and landlords, and Stessa has robust security measures in place that aim to keep everyone safe and secure.

With Stessa, investors who open a Stessa Cash Management account can supercharge how they manage their rental property finances. You can set up a separate bank account for each rental property or portfolio of assets, including accounts in the name of an LLC or other business entity. As an added benefit, Stessa’s Cash Management deposit accounts currently earn interest well above the national average on checking accounts.

Rent Collection Features

- Payment types: ACH

- Payment processing fees: None

- Deposit times: 3-5 business days

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Yes (requires paid account)

- Integrated accounting software: Yes

- Mobile app: Yes

Primary Limitation for Rent Collection

Credit cards are currently not supported as a rent payment option.

Accelerated rent payment deposits are included with Stessa’s paid subscription plans.

Pricing

The free Essentials plan includes all the above features (except accelerated rent payments). Landlords can subscribe to the Manage plan ($12/month paid annually), or the Pro plan ($28/month paid annually), to receive accelerated rent payments, eSign leases and contracts, Schedule E reporting, and more.

Go here to create a free Stessa account.

2. Avail

Avail is another option for collecting rent online. It offers a simple platform for landlords to collect and track rent payment history. It also has a mobile app for iOS and Android that makes it easy for tenants to pay their rent on the go. However, Avail charges tenants a fee to make rental payments each month, which may discourage some from paying the rent online.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: Tenant pays $2.50/ACH payment, waived if landlord subscribes to Unlimited Plus. Debit/credit card fees 3.5% regardless of subscription.

- Deposit times: 3-5 business days, or next day with an Unlimited Plus subscription to access FastPay

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes, via web-based landlord dashboard

- Accelerated rent payments: Yes, requires Unlimited Plus subscription

- Integrated accounting software: Yes

- Mobile app: No

Primary Limitation for Rent Collection

No mobile app for rent collection, requiring tenants to pay using a web browser.

Landlords must log-in to their dashboard to receive rent payment notification.

Pricing

Landlords need to subscribe to the Unlimited Plus plan at $9/month per unit in order to access features like FastPay, waived ACH payments for tenants, and accelerated rent payments.

3. Azibo

There are several pros and cons to using the Azibo rent collection tool to collect rent online. On the plus side, there are no landlord fees, and the system provides real-time updates and seamless accounting. However, one of the potential drawbacks to Azibo is that tenants are charged a fee for using a debit or credit card to pay the monthly rent.

Rent Collection Features

- Payment types: ACH, Debit/Credit, Cash App, cash payments through Chime

- Payment processing fees: ACH free for landlords and tenants. Tenants pay 2.99% for debit/credit payments, and may incur fees when paying via Cash App or Chime. Landlords have the option to enable interest-free installments via Livble for $30/month + $4.99/payment after 1st payment, fees paid by the tenant.

- Deposit times: As fast as 2 business days

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes, via landlord dashboard

- Accelerated rent payments: Yes

- Integrated accounting software: Yes

- Mobile app: No

Primary Limitation for Rent Collection

No mobile app for rent collection, requiring tenants to pay using a web browser.

Landlords must log-in to their dashboard to receive rent payment notification.

Pricing

All features are free for landlords. Tenants pay a processing fee depending on the rent payment method used.

4. Baselane

Baselane is another option to consider when choosing an online rent collection app. Like Stessa, the service offers an all-in-one financial platform for rent collection, banking, and bookkeeping. However, Baselane charges tenants a fee for paying the rent with a credit or debit card and does not offer all of the other property management features that some of the other tools on this list offer (e.g. tenant screening, vacancy marketing, tenant applications, etc.).

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: Free ACH for landlords using Baselane banking, otherwise $2/ACH paid by landlord or tenant if deposited into an external (non-Baselane) account. Debit/credit card fee 3.49% paid by tenant or landlord.

- Deposit times: 2 business days when using QuickPay and Baselane banking, up to 5 business days to an external bank account.

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Yes

- Integrated accounting software: Yes

- Mobile app: No

Primary Limitation for Rent Collection

No mobile app for rent collection, requiring tenants to pay using a web browser.

Pricing

Landlords need to use Baselane banking to receive accelerated rent payments in 2 days, otherwise it can take up to 5 days to receive payment. ACH fees (paid by landlord or tenant) are incurred when an external bank account is used.

A 3.49% fee is charged to tenants paying rent with a debit/credit card. Landlords depositing rent into Baseline banking pay $0 ACH for themselves or their tenants. The ACH fee is $2/transaction if the rent is paid into an external bank account, which can be charged to the tenant or landlord.

5. TurboTenant

TurboTenant may be a good choice for those who want a comprehensive solution for managing their rental properties. The software offers some of the features that Stessa does, including thorough user verification and ACH rent payments. On the other hand, their accounting integration may be limited, making it more challenging to track rental property performance in real time.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: ACH fee $2, waived if landlord has a Premium subscription. Debit/credit card fee 3.49%.

- Deposit times: ACH payment standard processing time 5-7 business days, 2-4 business days if the landlord has a Premium plan. Debit/credit card payment processing time is 2-3 business days.

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Yes, requires a Pro subscription or a Premium subscription

- Integrated accounting software: Income and expense reports only. Full accounting requires an REI Hub subscription

- Mobile app: Yes

Primary Limitation for Rent Collection

Processing time for ACH rent payments can be long compared to faster options like Stessa if the landlord doesn’t have a paid Premium subscription.

Pricing

A Pro subscription at $119/year or a Premium subscription at $149/year is required to access features like waived ACH fees for tenants and faster deposit times. In addition, a paid subscription to REI Hub at $15/month per property (with monthly pricing capped at $85/month) is required to generate financial reports like a rent roll.

6. ClickPay

Landlords can collect 100% of rent payments remotely with ClickPay’s online platform. Features include online payments, lockbox and check scanning, e-billing, and walk-in payment solutions. The company’s Invitation Wizard sets new tenants up in a matter of minutes, while landlord bank deposit reports make monthly reconciliations easier.

Rent Collection Features

- Payment types: ACH, Debit/Credit, bank bill pay, paper checks, walk-in payments

- Payment processing fees: 2.95% for debit/credit card payments, paid by tenant, rate may vary with some clients. Other fees not disclosed on the website.

- Deposit times: ACH payments are typically next business day. Payments by debit/credit card can take 3-4 business days.

- Autopay: Yes

- Late fees: No, only facilitates the payment process. Late fees must be charged manually.

- Automated rent reminders: Yes, but requires tenant to opt in

- Real-time payment notifications: Yes, but only for tenants

- Accelerated rent payments: No

- Integrated accounting software: No, but integrates with all leading HOA/Condo accounting software

- Mobile app: Yes, but only for tenants

Primary Limitation for Rent Collection

Best suited for HOAs, community associations, and professional property management companies with a large number of properties.

Pricing

Pricing varies based on the number of units under management and the contract negotiated with ClickPay. Typically a per-transaction fee of a percentage of the rent payment.

7. eRentPayment

The company provides landlords and tenants with flexible online rent payment options including one-time and recurring rent payments, credit card processing, and customizable settings for late fee assessments. A landlord can block partial rent payments, and tenants can build a credit history by reporting rent payments.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: Starts at $3/transaction for up to 3 payments per month. Can be paid by landlord, tenant, or evenly shared.

- Deposit times: Typically 3-4 business days

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: No

- Integrated accounting software: Limited to monthly transactions, deposits, and an accounting report.

- Mobile app: No

Primary Limitation for Rent Collection

No option for accelerated rent payments.

Financial reporting is limited, without access to a rent roll, rent ledger, or other standard accounting reports for landlords.

No mobile app means tenants and landlords need to use a web browser to access the platform.

Pricing

All features included as part of the per transaction payment fee. Standard plan is $3/transaction for up to 3 monthly transactions, or $2 for weekly recurring payments. Plus plan is $10/month and includes 5 transactions, with additional transactions billed at $1/each.

Visit the eRentPayment website

8. PayYourRent

Landlords with an LLC can receive same day rent payment processing, while tenants build their credit history with each rent payment. Tenants can pay a security deposit and the monthly rent by credit card or eCheck, and landlords get same-night rent deposits directly into their bank accounts. Other services from PayYourRent include rental applications, tenant screening, and maintenance requests.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: First transaction each month is free, $2.50/each thereafter. Tenants pay debit/credit card fees (exact amounts not disclosed on website).

- Deposit times: Next business day for corporations and LLCs. Payments to sole proprietorships may be held for 4-5 business days.

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Offers same-day payment processing as a standard feature

- Integrated accounting software: No

- Mobile app: Yes

Primary Limitation for Rent Collection

No free plan for collecting rent payments, although the first ACH transaction is free each month.

Lack of integrated accounting software requires landlords to use 3rd-party solutions.

Pricing

Subscriptions start at $9.95/month for up to 5 units and include 1 ACH transaction/month, $2.50/each per month thereafter. Tenants pay debit/credit card processing fees.

9. Rentec Direct (formerly TrueRent)

Rentec Direct offers free ACH online rent collection for both landlords and tenants and recurring billing to help increase income. The company’s QuickPay feature notifies a tenant when the rent is due, and rent payments are deposited directly into a landlord’s bank account. Late fees are automatically generated when a tenant is past due, and a new invoice is sent to a tenant showing the new total amount due including monthly rent and late fees.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: ACH payments free for landlords and tenants. Debit/credit card fees are 2.95% of the transaction amount, paid by tenant or landlord.

- Deposit times: 1-3 business days, depending on the bank’s processing time

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Offers Instant Tenant ACH debit option, although funding may still take 1-3 business days

- Integrated accounting software: Yes, but limited (general ledger accounting only). A QuickBooks subscription is required for comprehensive financial reports.

- Mobile app: Yes

Primary Limitation for Rent Collection

No free plan available for rent collection.

Pricing

A Rentec Pro subscription begins at $50/month for up to 25 units, including an unlimited number of tenants and properties.

Visit the Rentec Direct website

10. Buildium

The company claims to cut rent payment processing time by up to 70% when tenants add a bank or credit card account set up for recurring payments. Funds are automatically transferred to a landlord’s bank account, eliminating the need for a manual deposit. Buildium software also offers a full suite of property management services, including accounting, maintenance request tracking, rental listings, and tenant screening.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: $1.99/incoming EFT transaction, 2.99% per credit card transaction when using the Essential plan. Fees can be paid by the landlord or passed through to the tenant.

- Deposit times: Typically the following business day

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: No

- Accelerated rent payments: No, payments are typically deposited into landlord’s bank account the following business day

- Integrated accounting software: Yes

- Mobile app: Yes

Primary Limitation for Rent Collection

Collecting rent online using Buildium requires a landlord to subscribe to a paid subscription plan.

Plan prices may not be cost-effective for smaller landlords looking for an easy way to collect rent on line and manage their property accounting.

Pricing

There are no free plans with Buildium, but all features are included in every paid subscription plan. Pricing begins at $58/month for the Essentials plan with up to 20 units. EFT fees are reduced or waived on more expensive subscription plans. The Growth plan starts at $183/month and the Premium plan begins at $375/month, along with a one-time on-boarding fee. All plans offer a discount for annual billing, and a 14-day free trial.

11. PayRent

The company helps to make collecting rent more predictable for landlords and paying rent more rewarding for tenants. RentDefense offers an exclusive set of payment controls to help ensure on-time rent payments, while RentCred is a rewards program for tenants with reports sent to credit bureaus when the rent is paid on time.

Rent Collection Features

- Payment types: ACH, Debit/Credit

- Payment processing fees: Fees start at $6/bank transfer, 1.0% + $5.95 for a debit card transaction, and 3.5% + $5.95 for a credit card transaction, when using the free plan. Fees are reduced for paid plans.

- Deposit times: 5-day funding, with 3-day Express Funding available

- Autopay: Yes

- Late fees: Yes

- Automated rent reminders: Yes

- Real-time payment notifications: Yes

- Accelerated rent payments: Yes, requires a paid subscription plan

- Integrated accounting software: Limited to a renter account ledger. Transactions can also be exported to QuickBooks.

- Mobile app: No

Primary Limitation for Rent Collection

Lack of a mobile app may discourage some tenants from paying rent online.

Landlords must pay the ACH fee on the free plan, and tenants always pay the card transaction fees regardless of the selected plan.

Payment processing fees are higher than other rent collection apps like Stessa.

Pricing plans may be overly complex for landlords looking for an easy and cost-effective rent collection app.

Pricing

PayRent offers a Pay-As-You-Go free plan for landlords with less than 10 units. The Activation Fee for this plan is $10. Rent payment funding is 5 days, transfers are $6/each paid by the landlord, debit card rate is 1.0% + $5.95 per transaction, and the credit card rate is 3.5% + $5.95 per transaction. Automatic late fees are not included with this plan.

There are 2 other paid plans to choose from.

- Do-It-Yourself is $24/month for up to 30 units, after a 7-day free trial, and includes all features of the Pay-As-You-Go plan. The activation fee is waived, and bank transfers are reduced to $3/each. Debit and credit card fees are the same as with the Pay-As-You-Go plan. This plan includes automatic late fees.

- Go-Like-A-Pro is $59/month for professional property mangers with 25+ units, after a free 14-day trial, and includes all features of the Do-It-Yourself plan. The activation fee is waived, and bank transfers are free, with 3-day Express Funding. The debit card rate is reduced to 0% + $12 per transaction, and the credit card rate remains 3.5% + $5.95 per transaction.

12. Venmo

Venmo is a widely-used digital payment app that lets people quickly send and receive money between friends, with over 83 million active users on the platform. While it’s a convenient peer-to-peer payment solution, the app functions primarily as a social payment platform that may be better suited for casual transactions between individuals rather than formal business operations like collecting rent.

Rent Collection Features

- Payment types: ACH, Debit/Credit, Venmo Balance, Prepaid Card

- Payment processing fees: 3% transaction fee for businesses

- Deposit times: Up to 3 days before appearing in landlord’s bank account

- Autopay: No

- Late fees: No

- Automated rent reminders: No

- Real-time payment notifications: Yes

- Accelerated rent payments: No

- Integrated accounting software: No

- Mobile app: Yes

Primary Limitation for Rent Collection

While Venmo is a popular app used by consumers, it lacks popular rent payment features landlords look for, including auto pay, automatic late fees, and integrated accounting software.

Pricing

3% transaction fee for businesses.

13. Zelle

Zelle is a digital payment service that connects directly with users’ bank accounts and is integrated into many major U.S. banking apps, allowing for immediate transfers between bank accounts at no cost. While Zelle can handle large dollar amounts and doesn’t charge transaction fees, it’s important to note that the service doesn’t offer specific business features or landlord-tenant management tools, and many banks place daily transfer limits on Zelle transactions.

Rent Collection Features

- Payment types: ACH from participating financial institutions, Debit/Credit

- Payment processing fees: No

- Deposit times: Typically 1-2 days for payment to process

- Autopay: No, but some banks may allow users to set up recurring payments through Zelle

- Late fees: No

- Automated rent reminders: No

- Real-time payment notifications: Yes

- Accelerated rent payments: No

- Integrated accounting software: No

- Mobile app: Yes

Primary Limitation for Rent Collection

Zelle is a person-to-person payment service and lacks rent collection features like autopay, automated rent reminders, and integrated accounting software.

Transfers may be limited to $1,000/day and $5,000/month, depending on the bank. Not all financial institutions work with Zelle.

Pricing

There is no fee to use Zelle, but banks might charge a fee to send or receive money.